Audit and

Risk Committee

Notice of Meeting

An Audit and Risk Committee meeting will be

held in the Council Chamber, 26 Gordon Street, Dannevirke on Tuesday 16 June 2020 commencing following the conclusion of the workshop briefing session.

Blair

King

Chief

Executive

Agenda

1. Present

2. Apologies

3. Notification

of Items Not on the Agenda

4.

Confirmation of Minutes 3

Recommendation

That the

minutes of the Audit and Risk Committee meeting held on 17 March 2020 (as

circulated) be confirmed as a true and accurate record of the meeting.

5. Matters

Arising From the Minutes not otherwise dealt with in the Agenda

6. Reports

6.1 Health

and Safety 11

6.2 Project

Risk Management 17

6.3 Draft

Audit New Zealand Interim Management Report 2019/2020 23

6.4 Progress

with Audit New Zealand Findings and Recommendations 47

6.5 Audit

New Zealand Letters for Audit Engagement, Audit Plan and Audit Fee Proposal 53

6.6 Adoption

of Council's 2020/2021 Annual Plan and Schedule of Fees and Charges 97

7. Contract

Approval Under Local Authorities (Members Interests) Act 1968 111

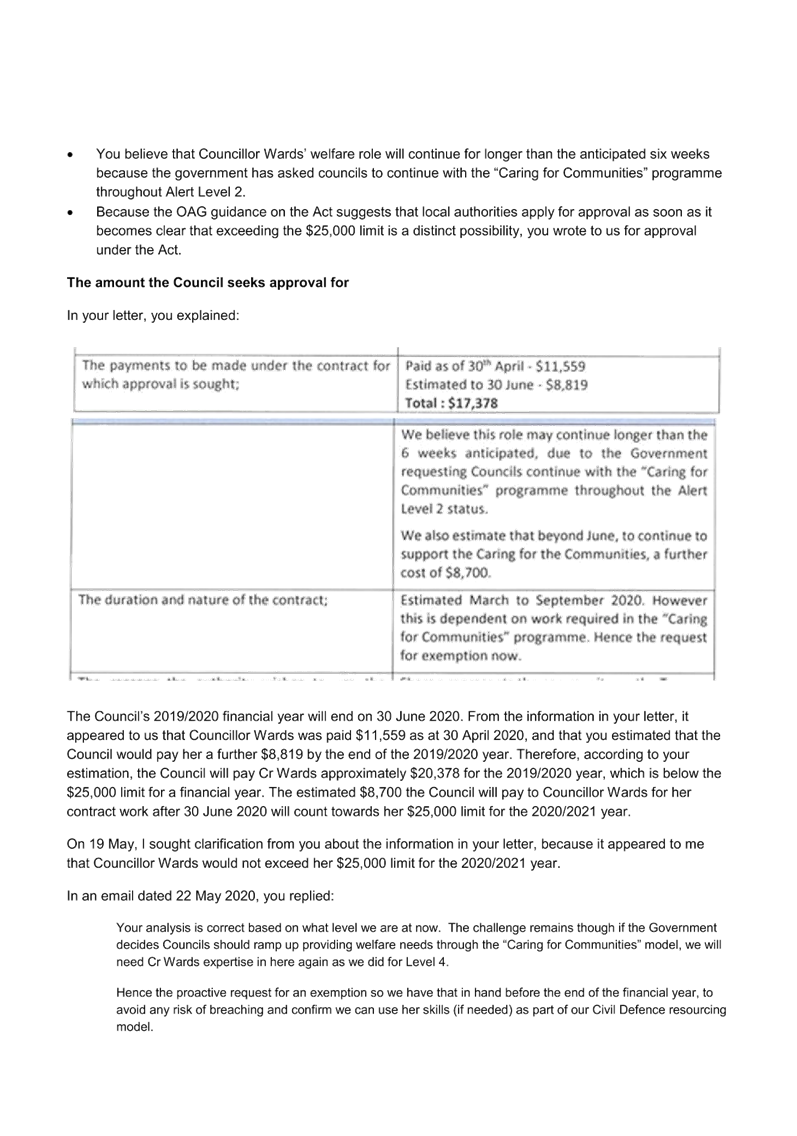

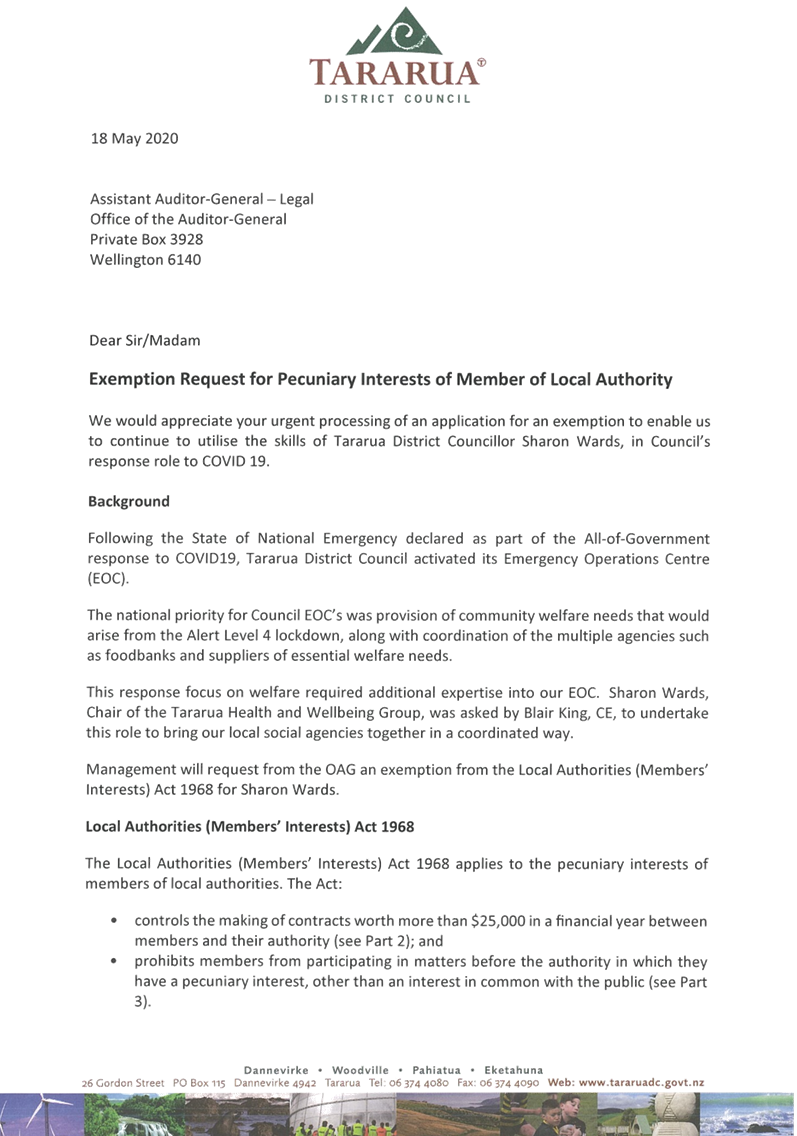

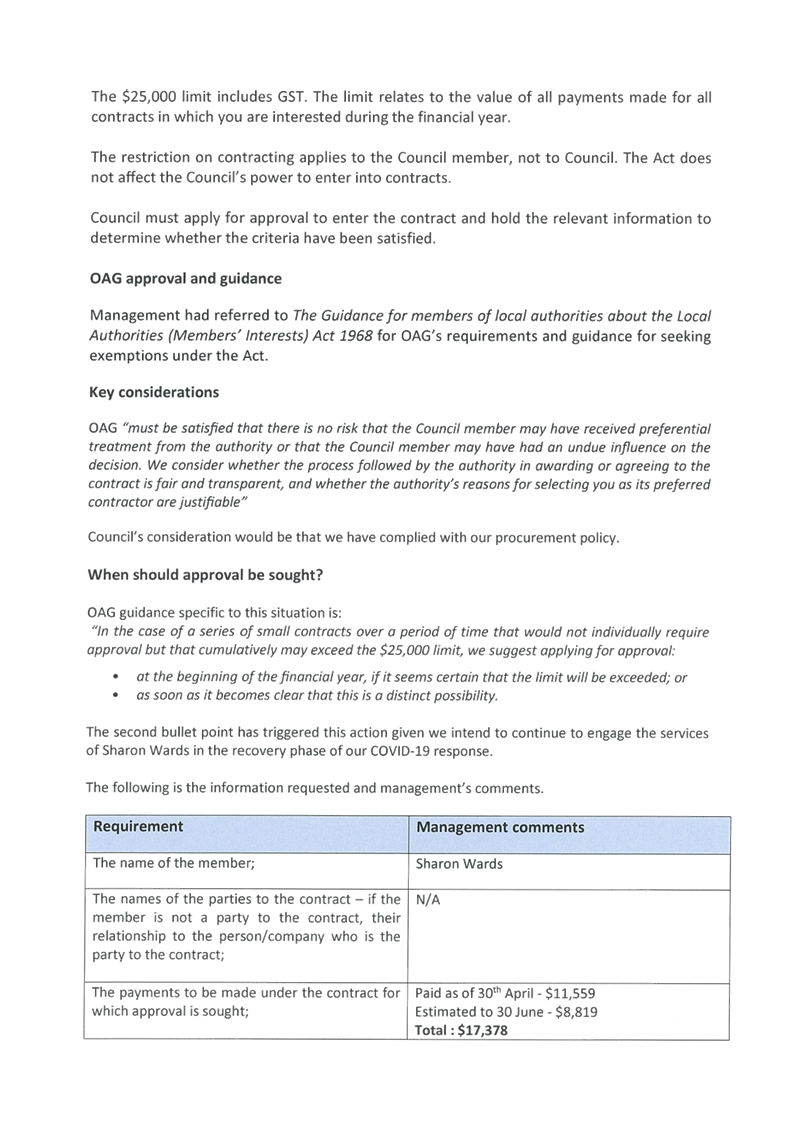

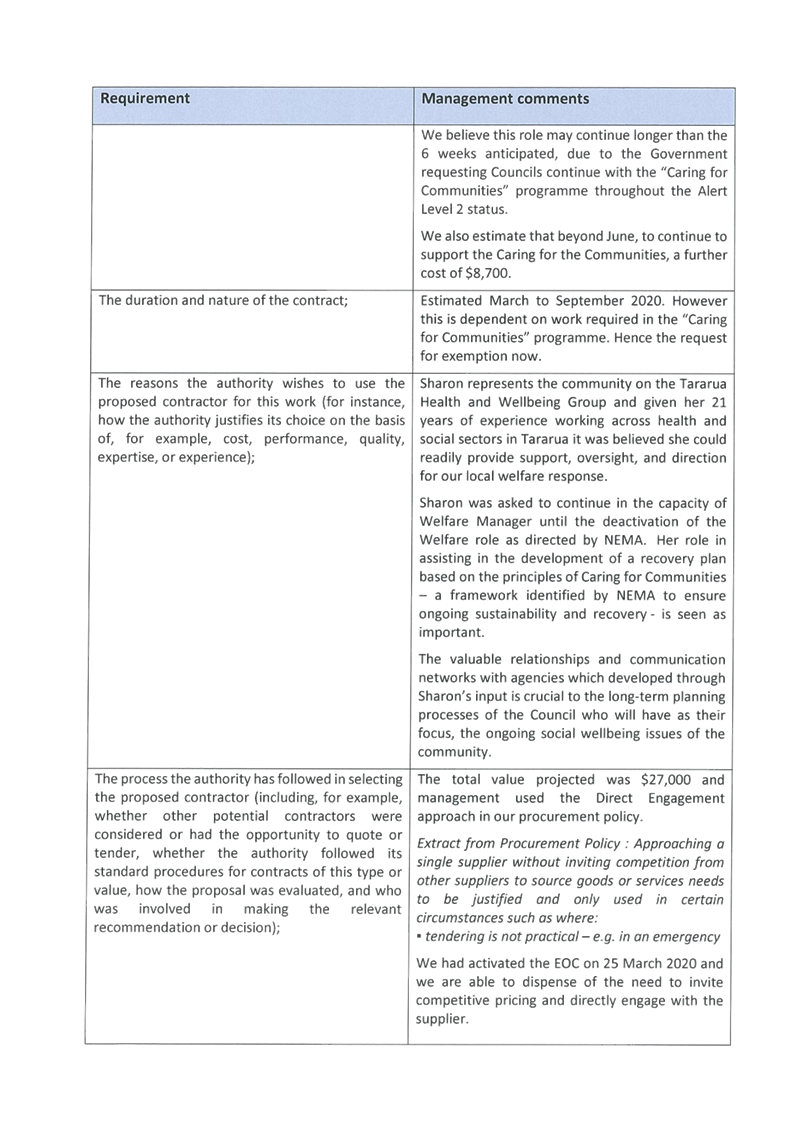

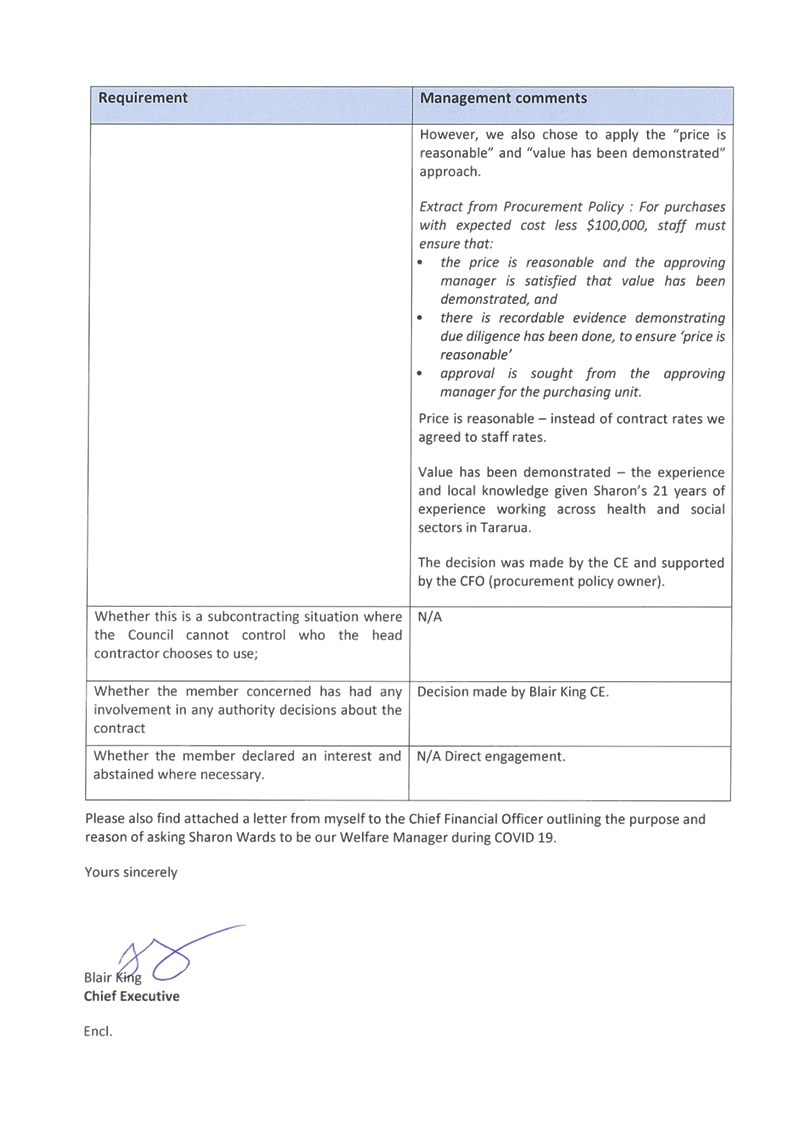

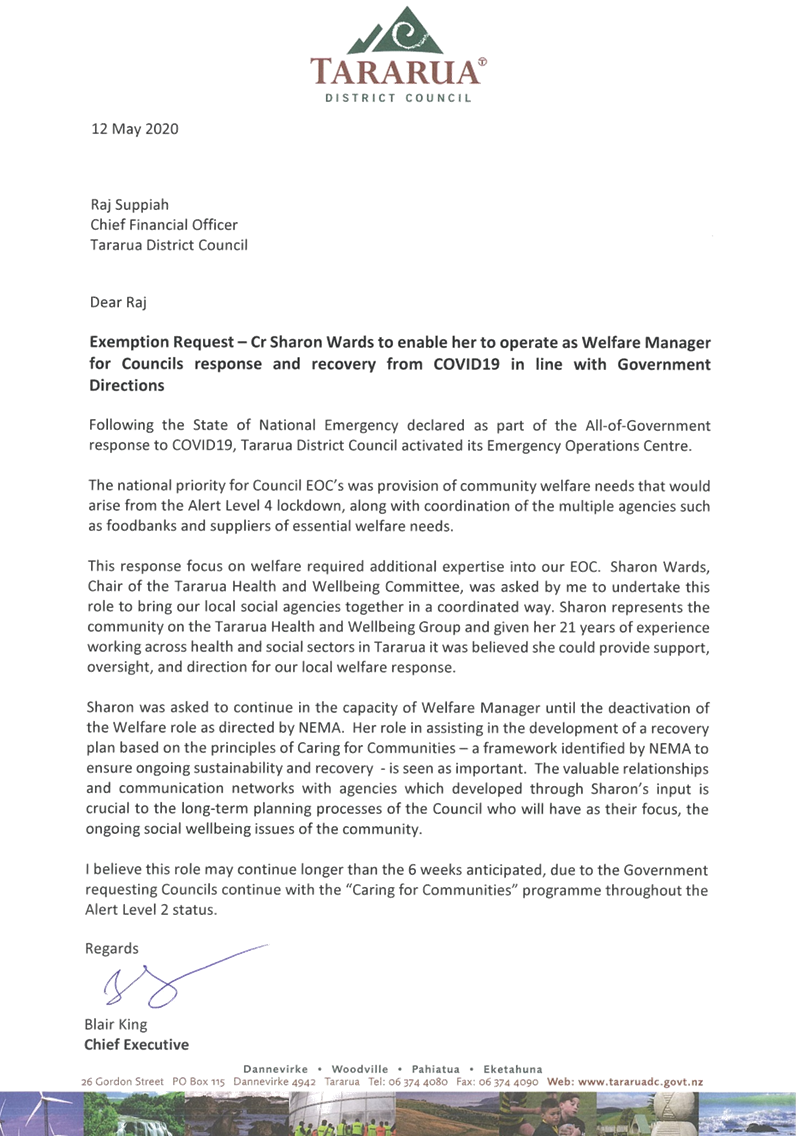

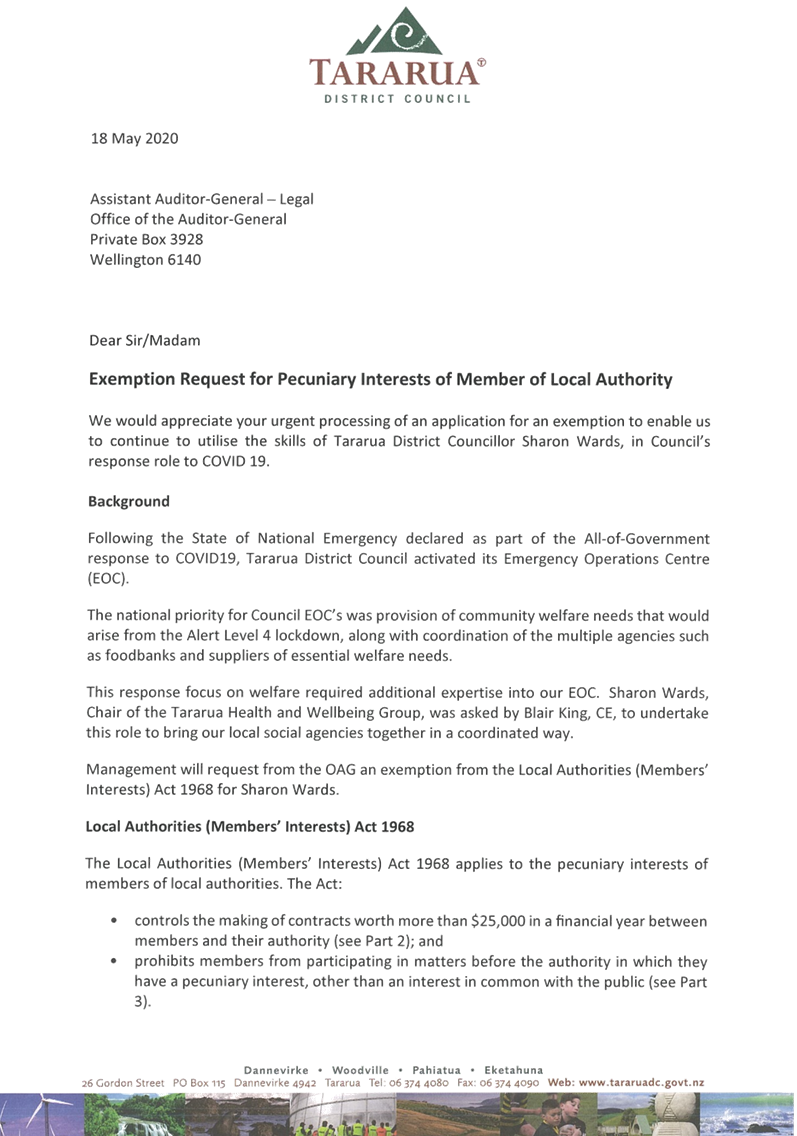

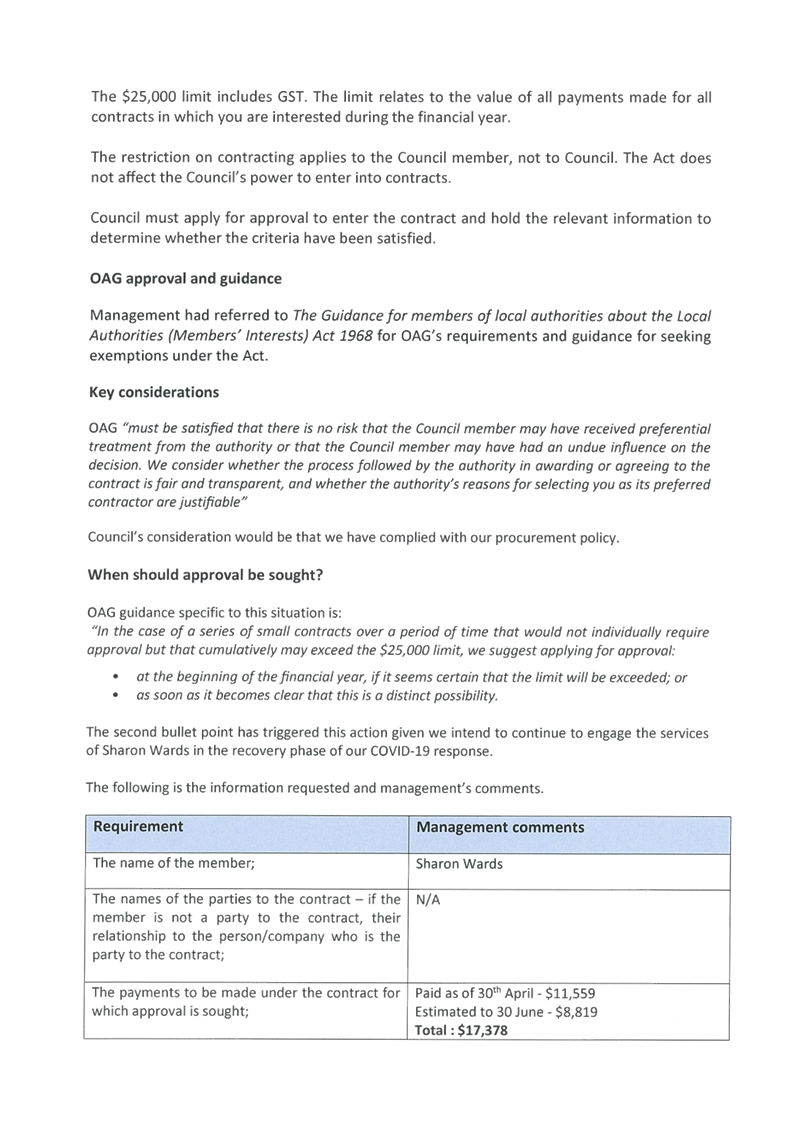

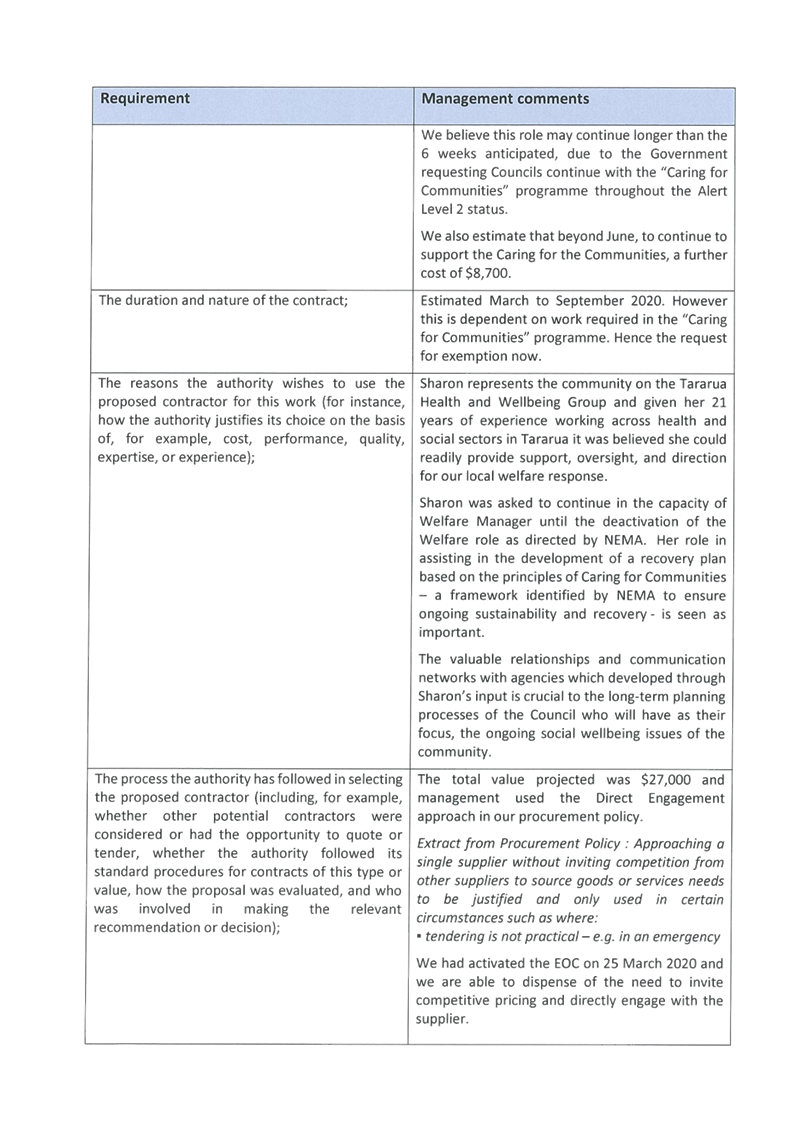

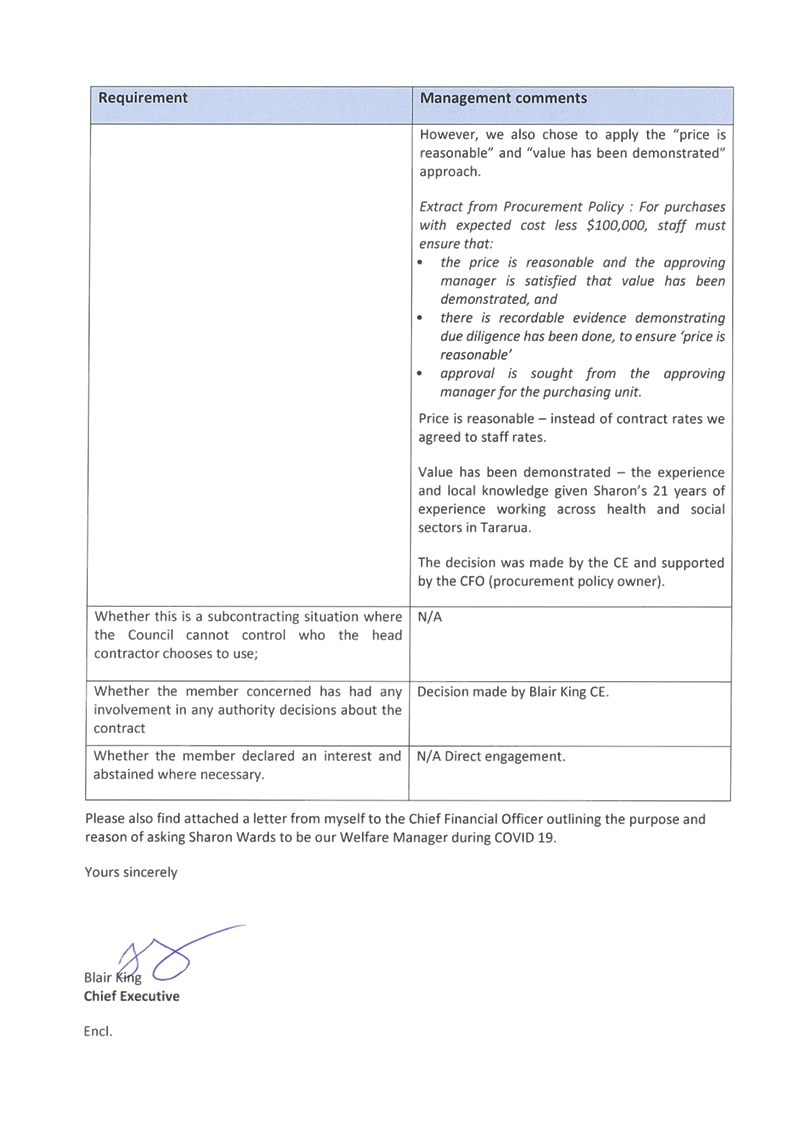

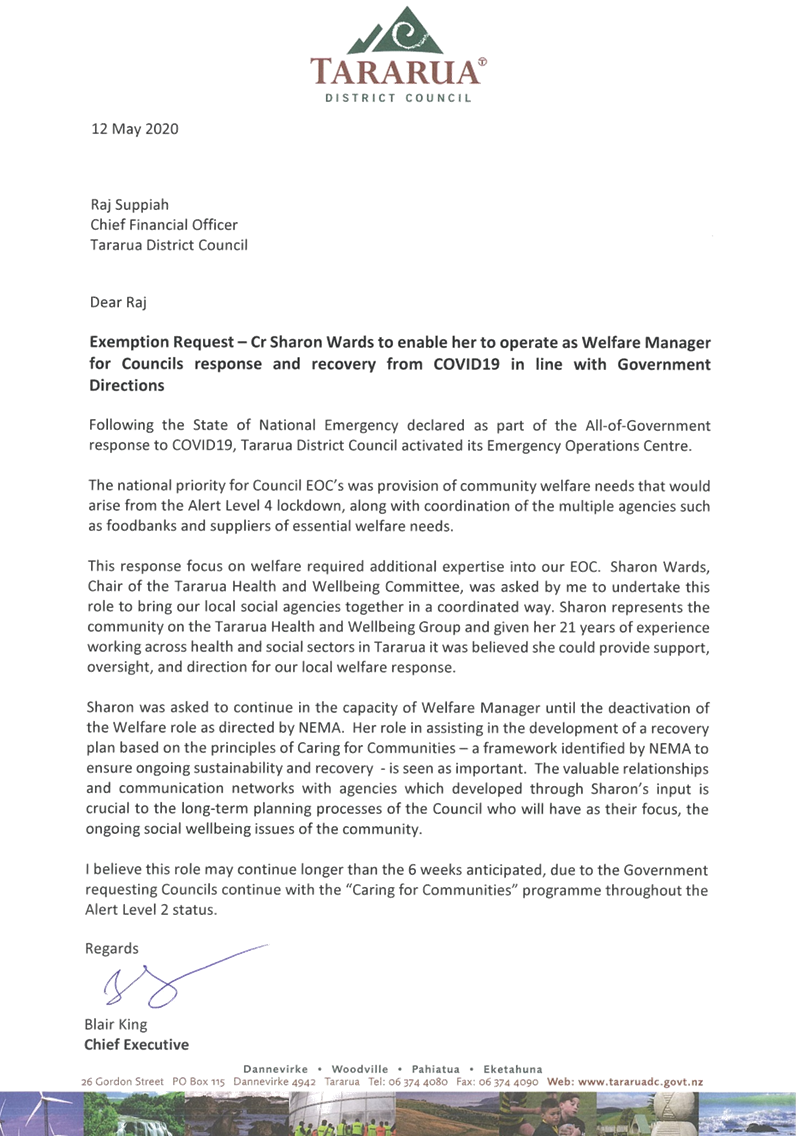

Attached for the Audit and Risk

Committee’s information is a copy of correspondence to the Office of the

Auditor-General and their approval of an application for payments to Cr S M

Wards to exceed the $25,000 limit in the 2019/2020 financial year.

Recommendation

That the Audit

and Risk Committee note the Office of the Auditor-General has granted approval

under Section 3 (3) (a) of the Local Authorities (Members Interests) Act 1968

for Cr S M Wards to be concerned or interested in a contract with Council for

services to the Emergency Operations Centre and the “Caring for

Communities Programme”, and

That this approval provides additional

payments can be made to Cr Wards up to the value of $30,000 (plus any GST

payable) for the 2019/2020 financial year.

8. Notified

Items Not on the Agenda

9. Closure

Audit and Risk Committee

Minutes of an

Audit and Risk Committee meeting held in the Council Chamber, 26 Gordon Street,

Dannevirke on Tuesday 17 March 2020 commencing at 1.00pm.

1. Present

Mr K Ross

(Chairperson), Her Worship the Mayor - Mrs T H Collis, Crs E L Peeti-Webber

(Deputy Mayor), A K Franklin, S A Hull,

C J Isaacson,

P A Johns,

R A Treder and S M Wards.

In

Attendance

Mr B King - Chief

Executive

Mr R Taylor - Governance

Manager

Mr R Suppiah - Chief

Financial Officer

Mr C McKay - Finance

Manager

Mrs S Walshe - Senior

Financial Accountant

Ms S Lowe - Risk

Manager

Mr H Featonby - Alliance

Planning Manager

Mr P Wimsett - Manager

Strategy and District Development

Mr D Le Mar - Financial

Accountant

Ms B Fowler - Financial

Accountant

Ms J McKenzie - Projects

Coordinator

Ms T Love - Programmes

and Projects Support

Ms G Tracy - Financial

Accountant

Mr B Rush - Health

and Safety Coordinator

Mrs A Howell - Risk

Administrator

2. Apologies

|

2.1

|

That an apology be sustained from Cr K A Sutherland

for non-attendance at the meeting.

Ross/Collis Carried

|

3. Notification

of Items Not on the Agenda

4. Reports

|

4.1

|

Health and Safety

|

|

4.1.1

|

That

the report from the Risk Manager dated 10 March 2020 concerning health and

safety (as circulated) be received, and

That

the Audit and Risk Committee note the following with regard to the focus on

health and safety matters and this update:

·

Emphasis is being placed on contractor

management.

·

The Health and Safety Committee is

reviewing the current systems and processes for staff working alone.

·

An annual review is being undertaken of

the health and safety registers.

·

All Council sites holding and using hazardous

substances are compliant with the Hazardous Substances Regulations (2017).

·

Council sites have been surveyed for

asbestos containing materials, and an asbestos management plan is in place to

manage any disturbance of these materials for regular maintenance,

demolition, disturbance, intentional damage and fire/natural disaster.

·

A SharePoint software system has been

created to house everything relating to Council’s management of health

and safety.

·

The Health and Safety Coordinator role

will be undertaken by Brook Rush of Manawatu District Council while the Risk

Manager takes a one year leave of absence from this position.

·

There has been a reduction in the number

of accidents and near miss events noted with regard to Council activities in

the last year.

Ross/Johns Carried

|

|

4.2

|

Risk Management

|

|

4.2.1

|

That

the report from the Risk Manager dated 10 March 2020 concerning risk

management (as circulated) be received, and

That

the Audit and Risk Committee note the risks arising from the spread of

coronavirus causing a human disease pandemic, and the actions taken by

Council through its continuity planning to respond to such an event impacting

on the district’s communities, and

That Council through its Long Term

Plan continue to place emphasis on building resilience into the provision of

the district’s water supplies to manage demand and the risks arising

from climate change and population growth, noting the impact of the current

drought and the critical water shortage crisis being experienced.

Hull/Treder Carried

|

|

4.3

|

Project Risk Management

|

|

4.3.1

|

That

the report from the Project Manager dated 10 March 2020 concerning project

risk management (as circulated) be received, and

That

the Audit and Risk Committee note the organisational approach and framework

developed and implemented as part of strengthening the way Council projects

are managed with regard to risk, and

That

the application of this approach to assess planning for risks relating to

projects and capital works proposed in the 2020/21 Annual Plan is

acknowledged.

Johns/Wards Carried

|

|

4.4

|

Draft Audit New Zealand Management Report

|

|

4.4.1

|

That

the report from the Senior Financial Accountant dated 10 March 2020

concerning the Draft Audit New Zealand management report (as circulated) be

received, and

That

the Audit and Risk Committee acknowledge an unmodified audit opinion was

issued by Audit New Zealand in respect of the 2018/19 Annual Report, and note

the following matters arising from the audit:

·

The need to ensure the quality and

timeliness of information completed by Council is as per the agreed audit

plan.

·

The reporting issue of non-consolidation

of Tararua Aquatic Community Trust’s financials is still outstanding.

·

The Principals Group for the IT Alliance

operational agreement is working towards implementing more formal monitoring

of the project schedule.

Hull/Franklin Carried

|

|

4.5

|

Progress with Audit New Zealand Findings and

Recommendations

|

|

4.5.1

|

That the report from the Finance

Manager dated 10 March 2020 concerning progress with Audit New Zealand

findings and recommendations (as circulated) be received, and

That progress by management in

implementing the Audit New Zealand recommendations is noted and acknowledged,

with six issues being closed in the Draft Audit Management Report, and

That the Audit and Risk Committee

acknowledge management is taking action to address the four outstanding Audit

New Zealand recommendations, and it shall continue to provide updates on this

matter as progress is made, and

That the Audit and Risk Committee

note the new Audit New Zealand recommendation regarding the IT Alliance

operational agreement, and the intention that the Principals Group shall work

towards implementing more formal monitoring of the project schedule.

Hull/Ross Carried

|

|

4.5.2

|

The meeting adjourned at 1.55pm, and resumed at 2.15pm.

|

|

4.6

|

Adoption of Council's Draft Annual Plan 2020/21

|

|

4.6.1

|

That the report from the Finance

Manager dated 10 March 2020 concerning adoption of Council's Draft Annual

Plan 2020/21 (as circulated) be received, and

That the recommendation regarding this matter is recognised as being

significant in terms of Council’s Significance and Engagement Policy,

and

That the Audit and Risk Committee

recommend to Council in accordance with Section 100 of the Local Government

Act 2002, the Draft Annual Plan 2020/21 budgets have been prepared based on

reasonable judgement and assumptions, and it considers the projected

financial results, including the projected operating deficit (section 8.1.6)

to be financially prudent given its financial position, and

That the Audit and Risk Committee

recommend to Council the Consultation Document and Draft Annual Plan and the

Fees and Charges Schedule for the 2020/21 financial year be adopted for

consultation (subject to the correction of any typographical errors or changes

which may be required), and with the addition of reference to the

developments regarding coronavirus in the Mayor’s message, and

That

the Audit and Risk Committee recommend to Council the activities of solid

waste management, animal control, footpaths, parks and reserves and

cemeteries fall outside the funding limits of its Revenue and Financing

Policy.

Johns/Hull Carried

|

|

4.7

|

New Zealand Transport Agency Technical Audit

|

|

4.7.1

|

That

the report from the Alliance Planning Manager dated 10 March 2020 concerning

the New Zealand Transport Agency technical audit (as circulated) be received,

and

That

the Audit and Risk Committee note the overall assessment from this audit is a

positive outcome, with no major improvements required or any compliance

breaches identified in respect of giving New Zealand Transport Agency

assurance it is receiving value for money and risks are being appropriately

managed, and

That the Audit and Risk Committee

acknowledge the intention of the Alliance leadership team to implement plans

to address the New Zealand Transport Agency recommendations for making

improvements regarding activity management planning and data quality

recording and reporting processes.

Collis/Hull Carried

|

|

4.8

|

Process to

Seek Expressions of Interest for the Audit and Risk Committee Chairperson

Appointment

|

|

4.8.1

|

The Chairperson declared a conflict of

interest regarding this item of business, and withdrew from the Council

Chamber while that matter was considered.

|

|

4.8.2

|

The Mayor chaired the discussion and

voting on the motion during this part of the meeting.

|

|

4.8.3

|

That

the report from the Chief Financial Officer dated 10 March 2020 concerning

the process to seek expressions of interest for the Audit and Risk Committee

Chairperson appointment (as circulated) be received, and

That

the proposed roles and responsibilities along with the draft advertisement to

seek expressions of interest for consideration to the appointment to this position

be agreed subject to including the following amendments:

·

Add financial acumen to the attributes

required of an ideal Chairperson.

·

Change the wording in the third bullet

point of attributes required of an ideal Chairperson to read “able to

work constructively with management and Council members”.

·

Specify the appointment to this position

shall extend to the period until year one of the new Council following the

2022 election.

And that the interview panel for this purpose comprise Her Worship

the Mayor - Mrs T H Collis, Cr S M Wards (Strategy and Policy Committee

Chairperson), Cr S A Hull (Economic

Development and Marketing Committee Chairperson), Cr

K A Sutherland (Works Liaison Committee Chairperson), Mr B King (Chief

Executive) and Mr R Suppiah (Chief Financial Officer).

Wards/Treder Carried

|

|

4.8.4

|

The Chairperson returned to the Council

Chamber following the completion of determining this item of business, and

assumed the chair for the remainder of the meeting’s proceedings.

|

|

4.8.5

|

The meeting adjourned at 3.25pm, and

resumed at 3.38pm.

|

5. Notified

Items Not on the Agenda

|

6.

|

Public Excluded Items of Business

|

|

6.1

|

That the public be excluded from the following parts of the

proceedings of this meeting, namely:

Alliance performance framework audit

Alliance financial audit

The general subject of each

matter to be considered while the public is excluded, the reason for passing

this resolution in relation to each matter, and the specific grounds under

Section 48 (1) of the Local Government Official Information and Meetings Act

1987 for the passing of this resolution follows.

|

General

subject matter to be considered

|

Reason for

passing this resolution in relation to each matter

|

Ground(s)

under Section 48(1) for the passing of this resolution

|

|

Alliance performance framework audit

|

To protect the commercial position of a third party

|

Section (1)(a)(i)

|

|

Alliance financial audit

|

To protect commercial activities

|

Section (1)(a)(i)

|

This resolution is made in

reliance on Section 48 (1) (a) of the Local Government Official Information

and Meetings Act 1987 and the particular interest or interests protected by

Section 6 or Section 7 of that Act or Section 6 or Section 7 or Section 9 of

the Official Information Act 1982, as the case may require, which would be

prejudiced by the holding of the whole or the relevant part of the

proceedings of the meeting in public are as follows:

s7(2)(b)(ii) The

withholding of the information is necessary to protect information where the

making available of the information would be likely unreasonably to prejudice

the commercial position of the person who supplied or who is the subject of

the information.

s7(2)(h) The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities.

Wards/Johns Carried

|

|

6.2

|

Alliance Performance Framework Audit

|

|

6.2.1

|

That the report from the Chief Financial Officer dated 10 March

2020 concerning the Alliance performance framework audit (as

circulated) be received, and

That progress and achievements made

by the Alliance management team as commended by the auditing team be noted

along with their recommendations for the 2018/19 financial year to keep the

performance framework relevant and aligned to the strategic intent and

detailed requirements of the Council.

Ross/Collis

Carried

|

|

6.3

|

Alliance Financial Audit

|

|

6.3.1

|

That the report from the Chief Financial Officer dated 10 March

2020 concerning the Alliance financial audit (as circulated) be received, and

That the

efforts of the Alliance management team and the Principals Group to ensure

that the pain/gain pool calculated fairly reflects the financial performance

for the 2018/19 financial year is noted and acknowledged.

Johns/Hull Carried

|

|

6.4

|

That open meeting be resumed.

Ross/Collis Carried

|

|

6.5

|

That the decisions taken with the public

excluded be confirmed in open meeting.

Ross/Collis Carried

|

|

7.

|

Health and Safety and Risk Management

|

|

7.1

|

Presentations were made in a workshop briefing session for the

purpose of discussion and information on the following matters:

·

Risk Manager - Health and safety induction

·

Risk Manager - Overview of Council’s

risk management framework

|

There being no further business the Chairperson thanked those present for their attendance and contributions, and

declared the meeting closed at 4.05pm and the workshop briefing session at

4.55pm.

____________________________

Chairperson

|

Date

|

:

|

9 June 2020

|

|

To

|

:

|

Chairperson and

Committee Members

Audit and

Risk Committee

|

|

From

|

:

|

Sandy Lowe

Risk Manager

|

|

Subject

|

:

|

Health

and Safety

|

|

Item No

|

:

|

6.1

|

1. Reason

for the Report

1.1 To

provide an update to the Audit and Risk Committee on health and safety matters.

2. Health

and Safety Coordinator Role

2.1 Due

to travel disruptions, Sandy Lowe is no longer embarking on a one-year career

break from Council and will be continuing in her role as Risk Manager.

2.2 Due

to resourcing shortages at Manawatu District Council, Brook Rush has been

delayed in beginning his secondment to Tararua District Council as the Health

and Safety Coordinator. Sandy Lowe will continue management of this area until

commencement of Brook’s secondment, which is expected mid-July 2020.

3. Health

and Safety Regional Group

3.1 No

update – investigation into a joint contractor management system is on

hold due to pandemic response and has not progressed since previously reported

in March.

4. Continual

Improvement

4.1 Work

will begin to organise the SafePlus assessment likely to be conducted at

Tararua District Council in December 2020.

4.2 Review

of the improvements since the December 2018 Audit are outlined below;

· We have

developed a formal staff reward and recognition programme for health and safety

– the health and safety star award

· We have

revamped the health and safety risk register to display the effectiveness of

controls in the risk assessment process

· Creation

of Health and Safety system through LOKI to ensure all Health and Safety

information is centralised

· All of

our Health and Safety Representatives completed training to increase their risk

management knowledge

· SHE

contractor management module is being implemented to ensure efficiency through

the contractor management process

· Risk

Register deep dives with each team, exploring their top risks – in

progress

· Creation

of the Health and Safety Critical Risks video

4.3 Review

of outstanding items still to be addressed;

· Develop an overarching strategic plan with measurable goals

· Implement a Council Officers’ Due Diligence plan to ensure

governance requirements for Health and Safety are in place

· Further development of the health and safety expectations for hiring

Council facilities

5. Health

and Safety Committee

5.1 After

missing committee meetings in both April and May, the committee has resumed

meetings as normal from 3 June 2020. These meetings are now available to be

attended remotely.

5.2 All

representatives have been asked to compile a report on current situations in

which staff work alone and what controls are currently in place. This will

inform a whole of Council review of the controls in place for this risk.

5.3 The

quarterly wellbeing activities, to support our wellness wheel, are on hold

until Brook Rush begins in the role of Health and Safety Coordinator in July

2020.

5.4 Anna

Sinclair and Brook Rush will be attending the Investigation Techniques Training

course through IMPAC to further their skills in managing incidents.

6. Risk

Management

6.1 Departmental

risk register reviews and deep dives into ‘top’ risks have been

rescheduled to resume from July when Brook Rush commences the Health and Safety

Coordinator role.

6.2 At

the beginning of Alert Level 3 Tararua District Council implemented a COVID-19

health and safety plan to provide guidance to staff of the expectations of

Tararua District Council in reducing transmission of the disease. This has been

reissued at Alert Level 2 and will be reissued again with the changes that

Alert Level 1 brings.

6.3 The

Government will be reducing the contact tracing requirements from Alert Level 1

and putting the onus back onto the customer, quick response (QR) codes for the

contact tracing app are being encouraged and we are investigating these for all

Council sites accessible to the public.

7. Contractor

Management

7.1 Implementation

of the new contractor management software has been delayed due to disruption

from the drought and COVID-19 response and recovery. Implementation likely

delayed until July 2020.

7.2 Throughout

Alert Level 3 and 2 COVID specific health and safety plans have been requested

from all contractors. This was to ensure the hygiene, contact tracing and

physical distancing elements were implemented into their day-to-day activities.

8. Hazardous

Substances Regulations (2017)

8.1 Peter

O’Donnell, an Environmental Engineer and Compliance Certifier from

Environmental Services has advised that a location compliance certificate is

not required for the Woodville Wastewater Treatment Plant.

8.2 A

peer review of our hazardous substances compliance is likely to be added as an

item to the internal audit calendar.

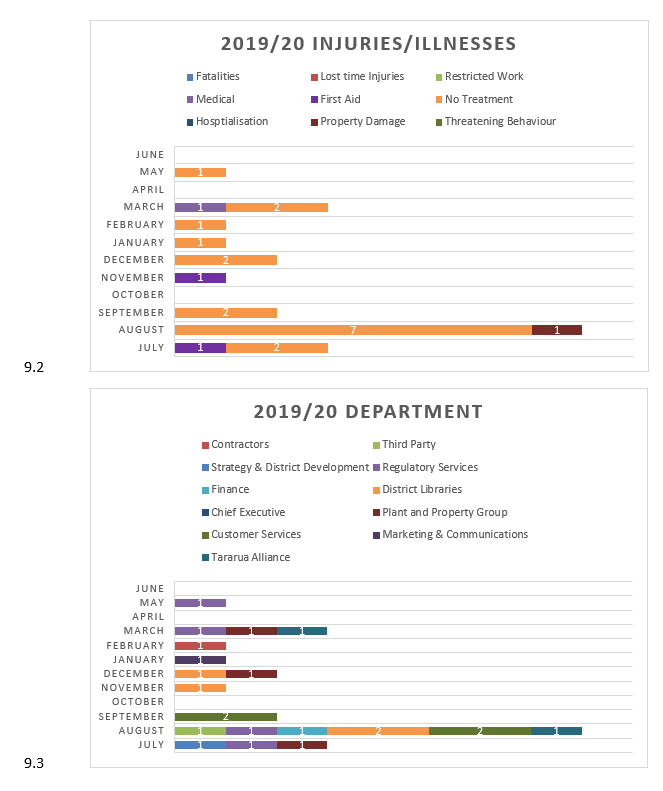

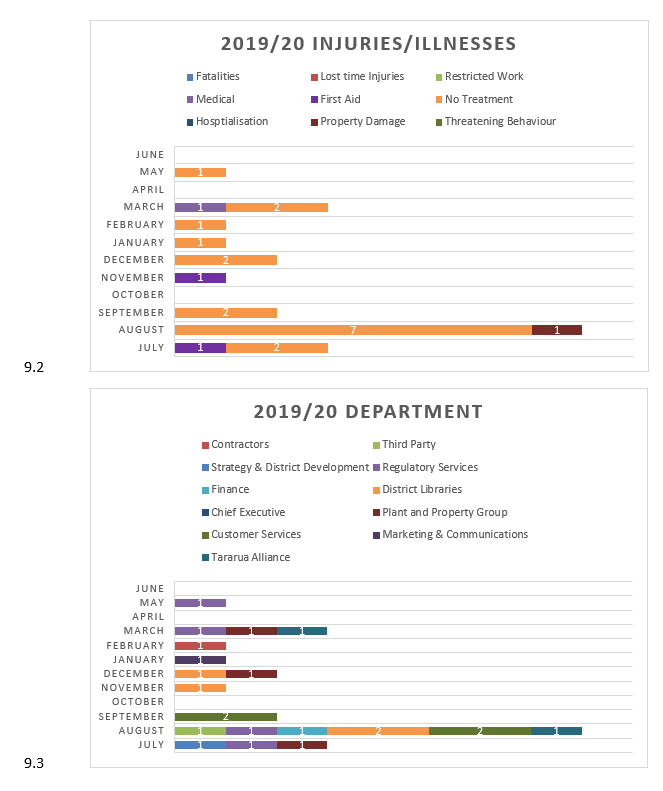

9. Accident

Investigation

9.1 Throughout

the lockdown period there have been minimal incidents which is reflective of

the change in the way we were working during this time.

|

10. Recommendation

10.1 That

the report from the Risk Manager dated 9 June 2020 concerning Health and

Safety (as circulated) be received, and

10.2 That

the Audit and Risk Committee note the following with regard to the focus on

health and safety matters and this update:

· The Health and Safety Coordinator secondment has been delayed

until mid-July 2020.

· Preparations are being made for the SafePlus audit towards the end

of the calendar year.

· Health and safety plans were implemented as guidance to staff and

contractors in managing the risks of Covid-19 and its transmission.

· A peer review of hazardous substances compliance is likely to be

added as an item for internal audit.

· Throughout Covid-19 lockdown there were only minimal health and

safety incidents reflecting the changed work environment during that period.

|

Attachments

Nil.

|

Date

|

:

|

9 June 2020

|

|

To

|

:

|

Chairperson and

Committee Members

Audit and

Risk Committee

|

|

From

|

:

|

Tina Love

Project

Manager

|

|

Subject

|

:

|

Project

Risk Management

|

|

Item No

|

:

|

6.2

|

1. Reason

for the Report

1.1 To

provide an update to the Audit and Risk Committee regarding the management of

project risk and the expectation for risk management in the 2020/2021 Annual

Plan and the 2021/2031 Long Term Plan.

2. Project

Risk Management

2.1 The

Programmes and Projects Office is reassessing the project risk process as part

of a Projects Management Office (PMO) framework improvement project and will

report on measures and/or solutions as these are developed. This

will include ways to improve the organisational project risk culture, provide leadership

and guidance for managing project risks, overseeing identified project risk for

all projects, and set the overall framework for project risk management by

working with project managers in identifying the most appropriate manner to

implement change.

2.2 The

PMO framework project will focus on 4 key project phases: Initiation, Design

and Planning, Execution and Closure. There is currently no consolidated view of

project risks across projects, but research and analysis on potential solutions

is underway as part of the PMO framework project. A nice to have requirement of

this solution is to include the ability to apply existing controls to project

risks, creating a 3-phase risk assessment and risk reduction plan; Inherent

Risk, Residual Risk, and Final Risk.

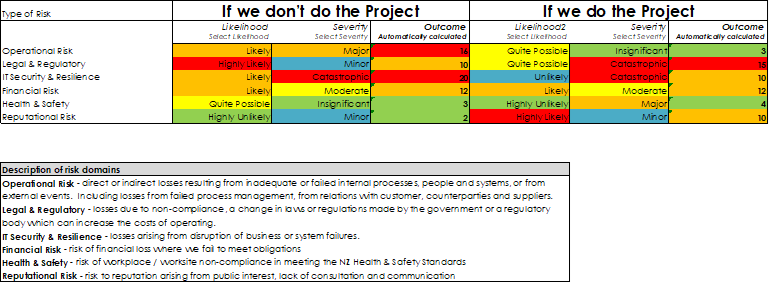

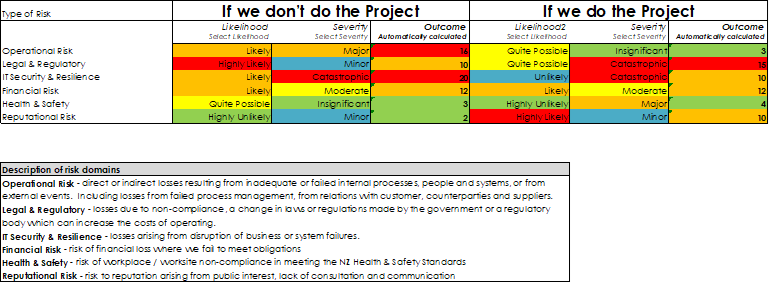

2.3 New

ideas are being developed within the project initiation phase to include

Project Concept, and Project Feasibility. The concept stage will ensure that

there is opportunity for a wider audience to input into ideas and identify

potential risks early. The project concept stage be trialled/tested against a

variety of project types, sizes, and risk profiles. An example of the concept

document is attached.

2.4 Introducing

project feasibility will ensure enough information is gathered to make informed

decisions on whether projects are viable. This stage is still being

fine-tuned as part of the PMO framework project.

2.5 Two

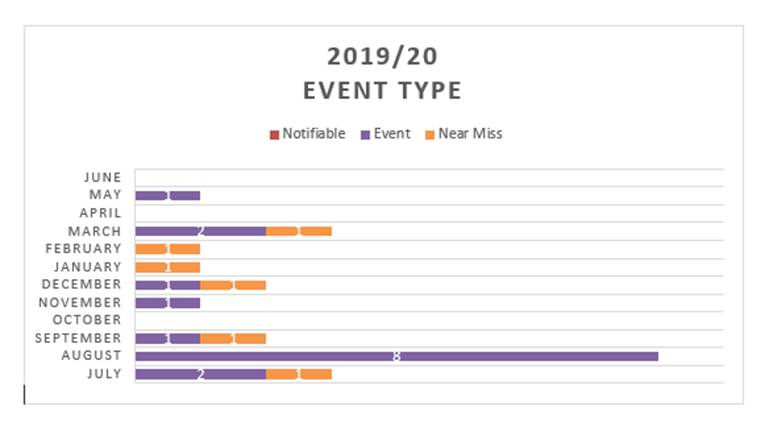

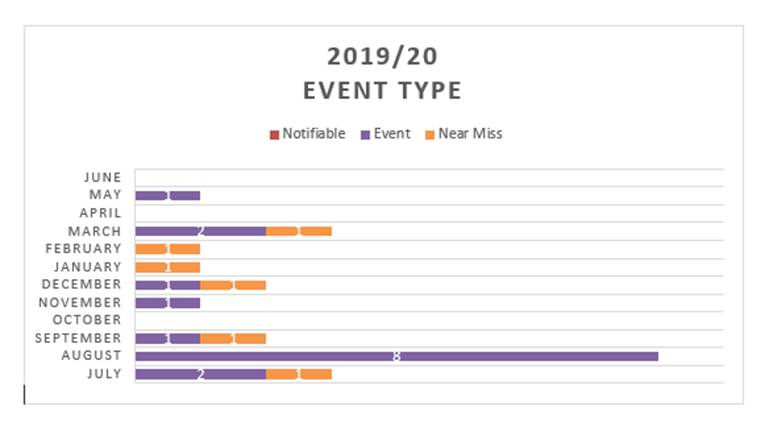

types of risk assessment are proposed for the feasibility stage. The first is

an assessment against “doing the project” versus “not doing the

project”, measured against risk domains such as operational risk, legal

& regulatory risk, IT security & resilience, financial risk, health and

safety risk, and reputational risk. An example is shown below:

2.6 The

second is a project complexity risk assessment (PCAT) which has been used for a

few projects that are currently in progress, however applying this assessment

during the feasibility stage ensures that the assessment is done earlier than

the project planning stage. As the PCAT template originates from Auckland City

Council, work needs to be completed to apply Tararua District Council specific

weightings to each of the assessment criteria, and a review of the criteria

descriptions to ensure they are fit for purpose.

3. Project

Planning for 2020/21 Projects

3.1 Planning

for projects and capital works for the 2020/21 Annual Plan is in progress. As

part of this work staff will be assessing the potential risks of each project

and documenting these in individual project risk registers. Future state will

have these risks documented in a consolidated register that can be reported on

in a variety of ways, however this will require a proper change management

process to successfully implement.

4. Managing

Project Risk for Current Projects

4.1 Project

risk for key projects is monitored on an ongoing basis through monthly project

status reports. This reporting is the responsibility of the project manager

with guidance from the Programmes and Projects Office and is presented to the

Works Liaison Committee.

4.2 Further

work is required for the Programmes and Projects Office to gain oversight of

risks across all projects to ensure these are regularly reviewed and updated.

This will be done in collaboration with the Council’s Risk Manager.

|

5. Recommendation

5.1 That

the report from the Project Manager dated 9 June 2020 concerning Project Risk

Management (as circulated) be received, and

5.2 That

the Audit and Risk Committee note the organisational approach and framework

developed and implemented as part of strengthening the way Council projects

are managed with regard to risk, and

5.3 That

the application of this approach to assess planning for risks relating to

projects and capital works proposed in the 2020/21 Annual Plan and 2021/2031

Long Term Plan is acknowledged.

|

Attachments

1⇩. Project concept on a page

6.2 Project Risk

Management

Attachment 1 Project

concept on a page

|

Date

|

:

|

9 June 2020

|

|

To

|

:

|

Chairperson and

Committee Members

Audit and

Risk Committee

|

|

From

|

:

|

Sarah Walshe

Senior

Financial Accountant

|

|

Subject

|

:

|

Draft

Audit New Zealand Interim Management Report 2019/2020

|

|

Item No

|

:

|

6.3

|

1. Reason

for the Report

1.1 To review and comment on the Audit New Zealand Interim Management

Report for the 2019/20 Annual Report.

2. Background

2.1 Audit

New Zealand has completed the interim audit of the Tararua District Council

2019/20 Annual Report. The attached report sets out their findings from the

audit and where appropriate makes recommendations for improvement.

3. Summary

of Findings

3.1 Audit

New Zealand concluded the following:

· Assessment of the control environment - Overall,

the auditors concluded that the District Council has appropriate and

operationally effective systems of internal control, which is consistent with

previous years.

· Internal controls – Controls over

key financial and non-financial information were reviewed and 2 recommendations

were made.

3.2 Matters

Noted during the interim audit;

3.2.1 There were 3

new recommendations made to the District Council as a result of the interim

audit, 2 of these were related to internal controls.

3.2.2 Impact of COVID-19 pandemic on the financial statements –

Council has been asked to prepare an assessment of the impact of COVID-19 on

its financial statements taking into account any drop-in revenue, increase in

expenditure, borrowings and compliance with its policies and relevant

legislation.

Management have

noted that to date the impact of COVID-19 on Council has not been significant.

Revenue from Fees &

Charges and other revenue (excluding rates) has been minimal. Council has seen

its NZTA subsidy revenue being affected due to the carry forward to the capital

programme into the next financial year. Debt levels were higher but that was as

a result of the cost variances for the capital projects, namely Pahiatua Water

Treatment Plant and Pahiatua Main Street upgrade. Additional costs incurred

were minimal. In fact, cost incurred by Council for the water crisis was more

significant than that of COVID-19. Council has considered the affordability and

prudent aspects from its financial strategies in the 2020/21 Annual Plan and

will look to discuss these comments and address any audit concerns with the

audit team.

3.2.3 Bank

Reconciliations – ensure that reconciliations are signed and dated by the

preparer and the reviewer within a month of being prepared.

Management has

noted this and will ensure that bank reconciliations reviewed, signed and dated

in a timely manner. During COVID-19 and staff working remotely management

implemented a process of having these sent and approved via email weekly and is

continuing this process moving forward.

3.2.4 Sensitive expenditure

policy – recommendation that the sensitive expenditure policy be updated

to reflect best practice and the Office of the Auditor General (OAG) guidance.

Management noted

this and advise that the policy is being updated and will ensure it is consistent

with OAG guidance.

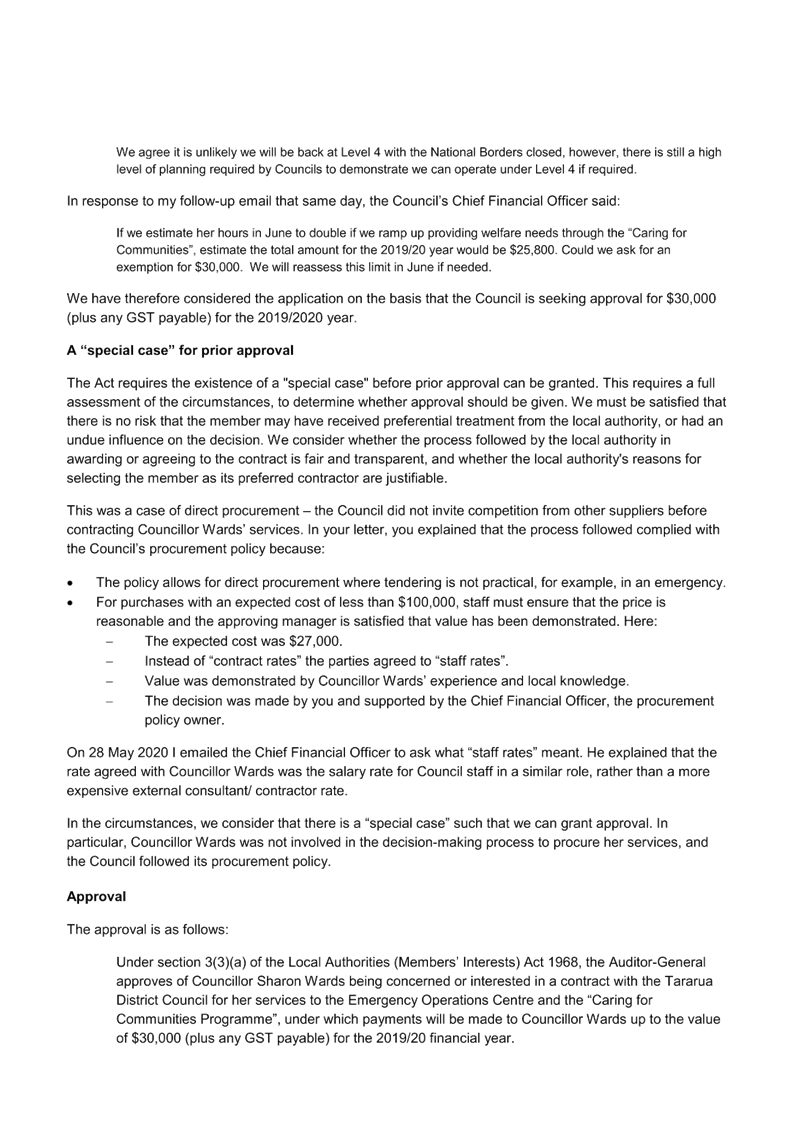

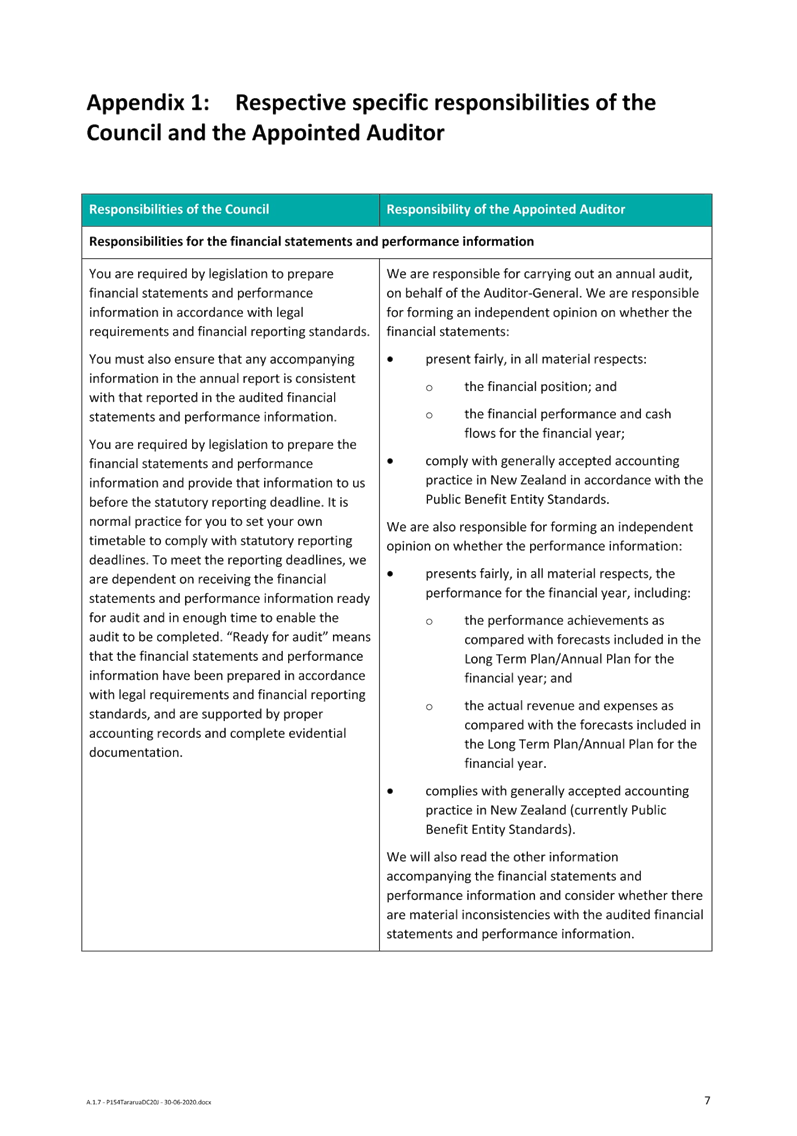

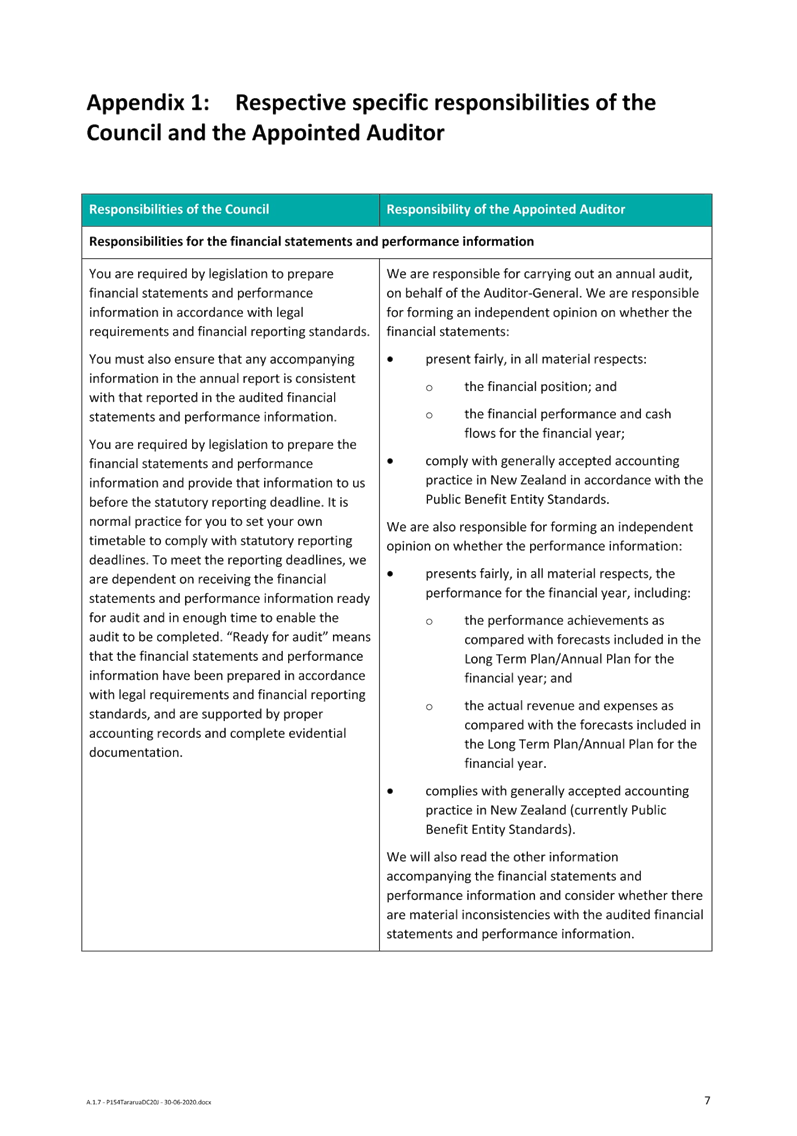

4. Status

of Previous Recommendations

|

Priority

|

Priority

|

|

Urgent

|

Necessary

|

Beneficial

|

Total

|

|

Open

|

0

|

4

|

0

|

4

|

|

Implemented or closed

|

0

|

0

|

0

|

0

|

|

Matters that will be followed up during

our final audit visit

|

0

|

2

|

2

|

4

|

|

Total

|

0

|

6

|

2

|

8

|

4.1 Status

of previous recommendations is set out in appendix 1 of the attached draft

report to the Council on the interim audit of Tararua District Council for year

ending 30 June 2020 and discussed further in Raj Suppiah’s Progress with

Audit New Zealand Findings and Recommendations Report.

5. Adoption

of New Accounting Standards

5.1 Audit

New Zealand have raised the adoption of new accounting standards with the

Council with regards to public benefit entities needing to comply with the new

“group” accounting standards PBE IPSAS 34 Separate

Financial Statements, PBE IPSAS 35 Consolidated Financial Statements,

PBE IPSAS 36 Investments in Associates and Joint Ventures, PBE IPSAS 37 Joint

Arrangements, and PBE IPSAS 38 Disclosure of Interest in Other Entities,

in preparing their 30 June 2020 financial

statements.

Management have

noted this and advised that they have sought advice from PWC with regards to

the consolidation of the Tararua Aquatic Community Trust in light of these new

standards and will develop a transition plan if required and continue to work

with the auditors on this matter.

6. Conclusion

6.1 The

attached report concerning Draft Audit New Zealand Interim Management Report

2019/2020 is received and the recommendations noted.

|

7. Recommendation

7.1 That

the report from the Senior Financial Accountant dated 9 June 2020 concerning

the Draft Audit New Zealand Interim Management Report 2019/2020 (as

circulated) be received, and

7.2 That

the Audit and Risk Committee note the assessment of the control environment

has concluded Council has established appropriate and operationally effective

systems for internal controls, with two recommendations made in respect of

key financial and non-financial information, and

7.3 That

the draft management comments on the impact of the Covid-19 pandemic for

reference in the financial statements, and actions to review bank

reconciliations and update the sensitive expenditure policy be noted with

management to finalise these comments.

|

Attachments

1⇩. Draft Audit New Zealand Interim Management

Report

6.3 Draft Audit New

Zealand Interim Management Report 2019/2020

Attachment 1 Draft

Audit New Zealand Interim Management Report

·

t

t

·

·

·

·

·

·

·

·

Report to the Council

on the interim audit of

Tararua District Council

For the year

ending 30 June 2020

·

Contents

|

·

Key messages. 3

·

1.................................................................................................................. Recommendations. 5

·

2........................................................................................... Assessment of internal control 7

·

3........................................................................... Matters noted during the interim audit 9

·

4............................................................................ Adoption of new accounting standards. 12

·

5................................................................................................................. Useful publications. 13

·

Appendix 1: Status

of previous recommendations. 16

·

Appendix 2:

Disclosures. 18

·

|

·

·

Key messages

·

We have completed our interim

audit for the year ending 30 June 2020. This report sets out our findings

from the interim audit.

Summary

·

We performed an assessment of the

District Council’s control environment. In performing this assessment, we

considered both the design effectiveness and operational effectiveness of

internal control.

·

Overall we have assessed the

control environment as “effective” based on work done to date. This

means, based on the work we performed, the District Council has adequate

internal controls in place that will either prevent or detect material

misstatements in its financial statements and statement of service performance.

We have however identified where improvements can be made. Our recommendations

are set out in section 1, 3 and Appendix 1 of this report.

·

COVID-19

·

On March 11, 2020, the World

Health Organization declared the outbreak of a coronavirus (COVID-19) a

pandemic and two weeks later the New Zealand Government declared a State of

National Emergency. From this the country was in lockdown. As a result of the

lockdown, economic uncertainties have arisen which are likely to negatively

affect the operations and services of the District Council. The full impact is

not yet known. For more details, refer to section 3.1.

·

New group accounting standards

·

Public benefit entities must apply

the new “group” accounting standards, PBE IPSAS 34 Separate

Financial Statements, PBE IPSAS 35 Consolidated Financial Statements,

PBE IPSAS 36 Investments in Associates and Joint Ventures, PBE IPSAS 37 Joint

Arrangements, and PBE IPSAS 38 Disclosure of Interest in Other Entities,

in preparing their 30 June 2020 financial statements.

·

Management is responsible for

performing the necessary transition work to successfully implement these new

standards. We encourage the District Council to share its transition plan and

transition work with us early in the audit process so we can agree issues and

adjustments in a timely manner.

·

In particular we have identified

that the consolidation of the Tararua Aquatic Community Trust needs to be

considered in light of these new standards. We are currently working with the

District Council to assess this impact.

Thank

you

·

We would like to thank management

and staff for their assistance during the interim audit, particularly as the

audit commenced at the same time as the country as going into lockdown and

Council staff were organising themselves to work from home. We would like to

acknowledge the District Council staff for the way that they worked with us in

these difficult circumstances.

·

·

·

·

Debbie Perera

·

Appointed Auditor

·

DRAFT – 8 June 2020

·

1  Recommendations

Recommendations

1

Our recommendations for

improvement and their priority are based on our assessment of how far short

current practice is from a standard that is appropriate for the size, nature,

and complexity of your business. We use the following priority ratings for our

recommendations.

|

Priority

|

Explanation

|

|

·

Urgent

|

·

Needs to be

addressed urgently

·

These

recommendations relate to a significant deficiency that exposes the District

Council to significant risk or for any other reason need to be addressed

without delay.

|

|

·

Necessary

|

·

Address at the

earliest reasonable opportunity, generally within six months

·

These

recommendations relate to deficiencies that need to be addressed to meet

expected standards of best practice. These include any control weakness that

could undermine the system of internal control.

|

|

·

Beneficial

|

·

Address, generally

within six to 12 months

·

These

recommendations relate to areas where the District Council is falling short

of best practice. In our view it is beneficial for management to address

these, provided the benefits outweigh the costs.

|

·

1.1 New

recommendations

2

The following table summarises our

recommendations and their priority.

|

Recommendation

|

Reference

|

Priority

|

|

·

Impact of the

Covid-19 pandemic on the financial statements

·

Prepare an

assessment of the impact of COVID-19 on the District Council’s

financial statements.

|

·

3.1

|

·

Necessary

|

|

·

Bank

reconciliations

·

Ensure that

reconciliations are signed and dated by the preparer and reviewer within a

month of being prepared.

|

·

3.2

|

·

Necessary

|

|

·

Sensitive

expenditure policy

·

Update the sensitive

expenditure policy to reflect best practice and the OAG guidance.

|

·

3.3

|

·

Necessary

|

·

1.2 Status

of previous recommendations

3

Set out below is a summary of the

action taken against previous recommendations. Appendix 1 sets out the status

of previous year’s recommendations in detail.

|

Priority

|

Priority

|

|

Urgent

|

Necessary

|

Beneficial

|

Total

|

|

·

Open

|

·

0

|

·

4

|

·

0

|

·

4

|

|

·

Implemented or

closed

|

·

0

|

·

0

|

·

0

|

·

0

|

|

·

Matters that will be

followed up during our final audit visit

|

·

0

|

·

2

|

·

2

|

·

4

|

|

·

Total

|

·

0

|

·

6

|

·

2

|

·

8

|

·

·

2  Assessment

of internal control

Assessment

of internal control

4

The Council, with support from

management, is responsible for the effective design, implementation, and

maintenance of internal controls. Our audit considers the internal control

relevant to preparing the financial statements and the service performance

information. We review internal controls relevant to the audit to design audit

procedures that are appropriate in the circumstances. Our findings related to

our normal audit work, and may not include all weaknesses for internal controls

relevant to the audit.

2.1 Control

environment

5

The control environment reflects

the overall attitudes, awareness and actions of those involved in

decision-making in the organisation. It encompasses the attitude towards the

development of accounting and performance estimates and its external reporting

philosophy, and is the context in which the accounting system and control

procedures operate. Management, with the oversight of Council, need to

establish and maintain a culture of honesty and ethical behaviour through

implementation of policies, procedures and monitoring controls. This provides

the basis to ensure that the other components of internal control can be

effective.

6

We have performed a high level

assessment of the control environment, risk management process, and monitoring

of controls relevant to financial and service performance reporting. We

considered the overall attitude, awareness, and actions of the Council and

management to establish and maintain effective management procedures and

internal controls.

We

consider that a culture of honesty and ethical behaviour has been created. The

elements of the control environment provide an appropriate foundation for other

components of internal control.

2.2 Internal

controls

7

Internal controls are the policies

and processes that are designed to provide reasonable assurance as to the

reliability and accuracy of financial and non-financial reporting. These

internal controls are designed, implemented and maintained by the Council and

management.

8

We reviewed the internal controls,

in your information systems and related business processes. This included the

controls in place for your key financial and non-financial information systems.

During the interim audit, we considered the following systems:

· Revenue and accounts receivable.

· Expenditure and accounts payable.

· Payroll.

· Cash and cash equivalents and investments.

· Property, Plant and Equipment and intangible assets.

· General ledger reconciliations and journals.

· Performance Reporting Systems and Controls

9

We have identified some

improvements which are detailed in section 3 and in Appendix 1.

3 Matters noted during the interim audit

3.1 Impact

of the COVID-19 pandemic on the financial statements

10

Recommendation

11

Prepare an assessment of the

impact of COVID-19 on the District Council’s financial statements.

Background

12

On March 11, 2020, the World

Health Organization declared the outbreak of a coronavirus (COVID-19) a

pandemic and two weeks later the New Zealand Government declared a State of

National Emergency. From this the country went into Alert Level 4, and

lockdown. As a result, economic uncertainties have arisen which are likely to

negatively affect the operations and services of the District Council.

13

While it is not yet possible to

determine the full impact of the COVID-19 pandemic on the District Council, it

may impact on:

· Council revenues and spending, borrowings and cash

flow;

· Value of investments and other assets measured at fair

value;

· Fair value assessments of infrastructure assets and

other property, plant and equipment measured at fair value across the group and

valuation triggers.

· Impairment

indicators of non-financial assets

· The 2020-21 rates setting and the annual plan process;

· Wider economic forecasts;

· Achieving service performance targets and levels of

service; and

· The Governance/Regulation work streams, including the

LTP process.

14

The Local Government Act 2002 (the

Act) puts an ongoing obligation on Councils to manage their finances prudently

as they make decisions over time. This is a long-term obligation rather than

something linked to a particular action, document, or event.

15

The onus is on Councils to ensure

that they have considered whether they are being financially prudent and to be

transparent about this with their communities.

16

Not all Councils will be affected

in the same way by COVID-19. However, many Councils are expecting a drop in

revenue.

17

Councils will need to consider all

available tools to address a drop in revenue and the possibility of additional

costs. This may include, for example, reviewing their current expenditure (what

should or shouldn’t be incurred). The District Council’s Audit and

Risk committee could provide helpful advice and support in this regard.

18

The District Council will also

need to consider their policies, borrowing terms and conditions, and

legislative requirements.

19

We will review the District

Council’s assessment the impact of COVID-19 on the operations and

services of the District Council and will confirm whether any disclosures

required in the financial statements are made appropriately relating to the

effect and the uncertainties caused by it.

20

We will also assess whether the

District Council has complied with its policies and the relevant legislation.

Management comment

21

The

impact of Covid-19 on Council has not been significant. Revenue from Fees &

Charges and other revenue (excluding rates) has been minimal. NZTA subsidy

revenue has been affected due to the carry forward to capital programme into

the next financial year.

22

Debt

levels were higher but that was a result of the cost variances for the capital

projects namely Pahiatua Water Treatment and Pahiatua Mainstreet projects.

23

Additional

cost incurred were minimal. In fact cost incurred for the water crisis were

more significant than Covi-19.

24

The

2020/21 Annual Plan has considered the affordability and prudent aspects in our

Financial strategies.

25

We will

discuss the above and the audit concerns further with the audit team

3.2 Bank

reconciliations

26

Recommendation

27

Ensure that reconciliations are

signed and dated by the preparer and reviewer within a month of being prepared.

28

Background

29

During the bank reconciliation

testing it was noted that the following bank reconciliations were not reviewed

on time:

· September was reviewed on 20 December 2019

· December was reviewed on 10 February 2020

30

This may result to errors not

being picked up on time by the reviewer.

31

We further noted that both of

these reconciliations did not have signature or date of the preparer meaning

that the timeliness of preparation could not be established.

32

Management comment

33

Noted. We

will ensure bank reconciliations are reviewed in a timely manner and are signed

and dated by the preparer and authoriser. During COVID-19 we implemented having

these be sent and approved via email weekly and will look to continue this

process moving forward.

34

3.3 Sensitive

expenditure policy

35

Recommendation

36

Update the sensitive expenditure

policy to reflect best practice and the OAG guidance.

37

Background

38

Our review of the sensitive

expenditure policy identified areas that did not meet OAG guidance. The

policies in place should meet OAG guidance to ensure that they provide

sufficient detail, cover all relevant areas of sensitive expenditure and are

reflecting best practice.

39

The sensitive

expenditure policy should be updated to meet OAG guidance and this should

include:

· Credit cards

· Rental cars

· Expenditure claims

· Approval of sensitive expenditure

· Koha

· Gift giving

40

Management

comment

41

Noted.

Policy is being updated and we will ensure it is consistent with OAG guidance.

4 Adoption of new accounting standards

Public benefit entities must apply the new

“group” accounting standards, PBE IPSAS 34 Separate

Financial Statements, PBE IPSAS 35 Consolidated Financial Statements,

PBE IPSAS 36 Investments in Associates and Joint Ventures, PBE IPSAS 37 Joint

Arrangements, and PBE IPSAS 38 Disclosure of Interest in Other Entities,

in preparing their 30 June 2020 financial

statements.

Public benefit entities must apply the new

“group” accounting standards, PBE IPSAS 34 Separate

Financial Statements, PBE IPSAS 35 Consolidated Financial Statements,

PBE IPSAS 36 Investments in Associates and Joint Ventures, PBE IPSAS 37 Joint

Arrangements, and PBE IPSAS 38 Disclosure of Interest in Other Entities,

in preparing their 30 June 2020 financial

statements.

Management is responsible

for performing the necessary transition work to successfully implement these

new standards. Areas of focus with the transition include:

· Assessing whether the revised control definition and

guidance result in an entity being assessed as controlled under PBE IPSAS 35

for those entities previously assessed as not controlled under prior standards.

For example, trusts established by Tararua District Council that support

Tararua District Council in achieving its objectives.

· Determining whether a joint arrangement is categorised

as a joint venture or joint operation. Joint ventures must be accounted for

using the equity method.

· Updating the “group” accounting policies

and “group” related disclosures in the financial statements. PBE IPSAS

38 generally requires more disclosure about interests in other entities than

the previous standards.

· Implementing changes to systems and processes that may

be necessary to support changes in accounting practices.

· Keeping relevant parties informed, such as your

auditor and audit committee.

The transition to these new

standards may require significant judgement for some arrangements and maybe

particularly time consuming for those entities with a large number of

potentially controlled entities. It is important that management substantially

completes its transition work on these new standards well in advance of 30 June 2020.

We recommend that as part of this, management prepare pro-forma financial

statements so that revised group-related disclosures can be agreed.

We encourage Tararua

District Council to share its transition plan and transition work with us early

in the audit process so we can agree issues and adjustments in a timely manner.

In particular we have identified that the consolidation of the Tararua Aquatic

Community Trust needs to be considered in light of these new standards. We are

currently working with the District Council to assess this impact.

42

Management

comment

43

Noted. We

have sought advice from PWC regards the consolidation of the Tararua Aquatic Community Trust in

light of these new standards.

5  Useful publications

Useful publications

44

Based on our knowledge of the

District Council, we have included some publications that the Council and

management may find useful.

45

|

Description

|

Where to find it

|

|

Model

financial statements

|

|

·

Our model financial

statements reflect best practice we have seen to improve financial reporting.

This includes:

· significant accounting policies are alongside the

notes to which they relate;

· simplifying accounting policy language;

· enhancing estimates and judgement disclosures; and

· including colour, contents pages and subheadings to

assist the reader in navigating the financial statements.

|

·

On our website under

publications and resources.

Link: Model Financial Statements

|

|

Tax

matters

|

|

|

·

As the

leading provider of audit services to the public sector, we have an extensive

knowledge of sector tax issues. These documents provide guidance and

information on selected tax matters.

|

·

On our website under

publications and resources.

·

Link: Tax Matters

|

|

Client

substantiation file

|

|

When you are fully prepared for an audit, it helps

to minimise the disruption for your staff and make sure that we can complete

the audit efficiently and effectively.

We have put together a tool box called the Client

Substantiation File to help you prepare the information you will need to

provide to us so we can complete the audit work that needs to be done. This

is essentially a tool box to help you collate documentation that the auditor

will ask for.

|

·

On the OAG’s

website under publications and resources.

Link: Client Substantiation File

|

|

Good

practice

|

|

·

The OAG’s

website has been updated to make it easier to find good practice guidance.

This includes resources on:

· audit committees;

· conflicts of interest;

· discouraging fraud;

· good governance;

· service performance reporting;

· procurement;

· sensitive expenditure; and

· severance payments.

|

·

On the OAG’s

website under good practice.

·

Link: Good

practice

|

|

Earthquake

accounting matters

|

|

The purpose of this document is to

provide a summary of Audit New Zealand’s views reached on earthquake

accounting issues and provides the following guidance:

· Accounting for insurance claims and receivables;

· Accounting for earthquake damage to PPE;

· Accounting for Government grants received that

relate to the earthquake;

· Investment property, lease, and other issues;

· Disclosures

|

·

On our website under

publications and resources.

·

Link: Earthquake accounting

|

|

Reporting

fraud

|

|

|

·

The OAG have

released data from 2012‑2018 on fraud in public entities. This includes

how the fraud was detected, the type of fraud and the methods and reasons for

the fraud. The graphs show the high-level sector, and this can be broken down

further into sub-sectors by opening the spreadsheets available.

|

·

On the OAG’s

website under data.

·

Link: Reporting

Fraud

|

Appendix

1: Status of previous recommendations

Open

recommendations

|

Recommendation

|

First raised

|

Status

|

|

Necessary

|

|

Age of rates

debtors

|

|

·

Review outstanding

rates debtors on a regular basis and that outstanding rates are reviewed for

recovery or write off.

|

·

June 2017

|

·

In progress:

·

Management continues

the focus on reducing the amount of outstanding rates debtors

|

|

Removal

of users access

|

|

·

Ensure council

managers and HR are providing information to IT promptly about additions,

changes and terminations of staff and contractors.

|

·

June 2018

|

·

In progress:

·

The following

actions have been undertaken:

· IT procedures reviewed and updated-User accounts

will be disabled in systems as soon as the IT alliance is notified of the

staff member leaving the organisation-

· Accounts are permanently removed upon receipt of

formal notice from HR.

We understand that Council is working on a series of

checks that will tighten control in this area, this will include regular

checking of contractor and temporary/casual staff accounts.

|

|

Sensitive

expenditure

|

|

·

Finalise the staff

handbook (sensitive expenditure) as soon as possible, reviewing it against

best practice, such as those set out in the OAG’s Guidelines as

applicable.

·

Ensure that

sensitive expenditure is approved as required by the policyto provide

enhanced control and judgements for sensitive expenditure that can withstand

public scrutiny.

|

·

April 2017

|

·

In progress:

·

The staff handbook

is currently being finalised.

|

|

Alliance

agreement

|

|

·

Update the

performance framework for the Alliance be updated to include specific

measures across roading, water and asset management to enable the District

Council to assess performance of the Alliance across the different services

delivered.

|

·

June 2017

|

·

In progress:

·

We understand that

the Council has agreed to the extension of the Alliance agreement. We will

complete our review when this has been signed.

|

|

Update

and test organisational business continuity and IT disaster recovery plans

|

|

·

Update and test IT

Disaster recovery plans and organisational business continuity plans.

|

·

June 2017

|

·

We will follow

this up during the final audit.

|

|

Formal

monitoring of alliance agreements for IT Services

|

|

·

We recommend that

the Principals Group meet as per the IT Alliance agreement, to

monitor the performance of the IT support provider.

·

The Principals

Group also need to finalise and monitor the project schedule.

|

·

June 2019

|

·

We will follow

this up during the final audit.

|

|

Beneficial

|

|

Carry-over

of capital projects

|

|

·

Continue to monitor

the level of carry forwards of capital expenditure and reduce these were

possible.

|

·

June 2014

|

·

We will follow

this up during the final audit.

|

|

Expenditure

approval

|

|

·

Implement one up

approval for purchases.

|

·

June 2017

|

·

We will follow

this up during the final audit.

|

Appendix 2: Disclosures

|

Area

|

Key messages

|

|

·

Our responsibilities

in conducting the audit

|

·

We carry out this

audit on behalf of the Controller and Auditor‑General. We are

responsible for expressing an independent opinion on the financial statements

and performance information. This responsibility arises from section 15 of the Public

Audit Act 2001.

·

The audit of the

financial statements does not relieve management or the Council of their

responsibilities.

·

Our audit engagement

letter contains a detailed explanation of the respective responsibilities of

the auditor and the Council.

|

|

·

Auditing standards

|

·

We carry out our

audit in accordance with the Auditor‑General’s Auditing

Standards. The audit cannot and should not be relied upon to detect every

instance of misstatement, fraud, irregularity or inefficiency that are

immaterial to your financial statements. TheCouncil and management are responsible for implementing and maintaining systems of

controls for detecting these matters.

|

|

·

Auditor independence

|

·

We are independent

of the District Council in accordance with the independence requirements of

the Auditor‑General’s Auditing Standards, which incorporate the

independence requirements of Professional and Ethical Standard 1 (Revised): Code

of Ethics for Assurance Practitioners, issued by New Zealand

Auditing and Assurance Standards Board.

·

To date, in addition to the

audit we have carried out engagements in the areas of the Debenture Trust

Deed, which are compatible with those independence requirements. Other than

the audit and these engagements, we have no relationship with, or interests

in, the District Council.

|

|

·

Fees

|

·

The audit fee for

the year is currently being negotiated through our Audit Proposal Letter.

·

To date, no other

fees have been charged in this period.

|

|

·

Other relationships

|

·

To date, we are not

aware of any situations where a spouse or close relative of a staff member

involved in the audit occupies a position with the District Council that is

significant to the audit.

·

We are not aware of

any situations to date where a staff member of Audit New Zealand has

accepted a position of employment with the District Council during or since the end of the financial year.

|

|

Date

|

:

|

9 June 2020

|

|

To

|

:

|

Chairperson and

Committee Members

Audit and

Risk Committee

|

|

From

|

:

|

Raj Suppiah

Chief

Financial Officer

|

|

Subject

|

:

|

Progress

with Audit New Zealand Findings and Recommendations

|

|

Item No

|

:

|

6.4

|

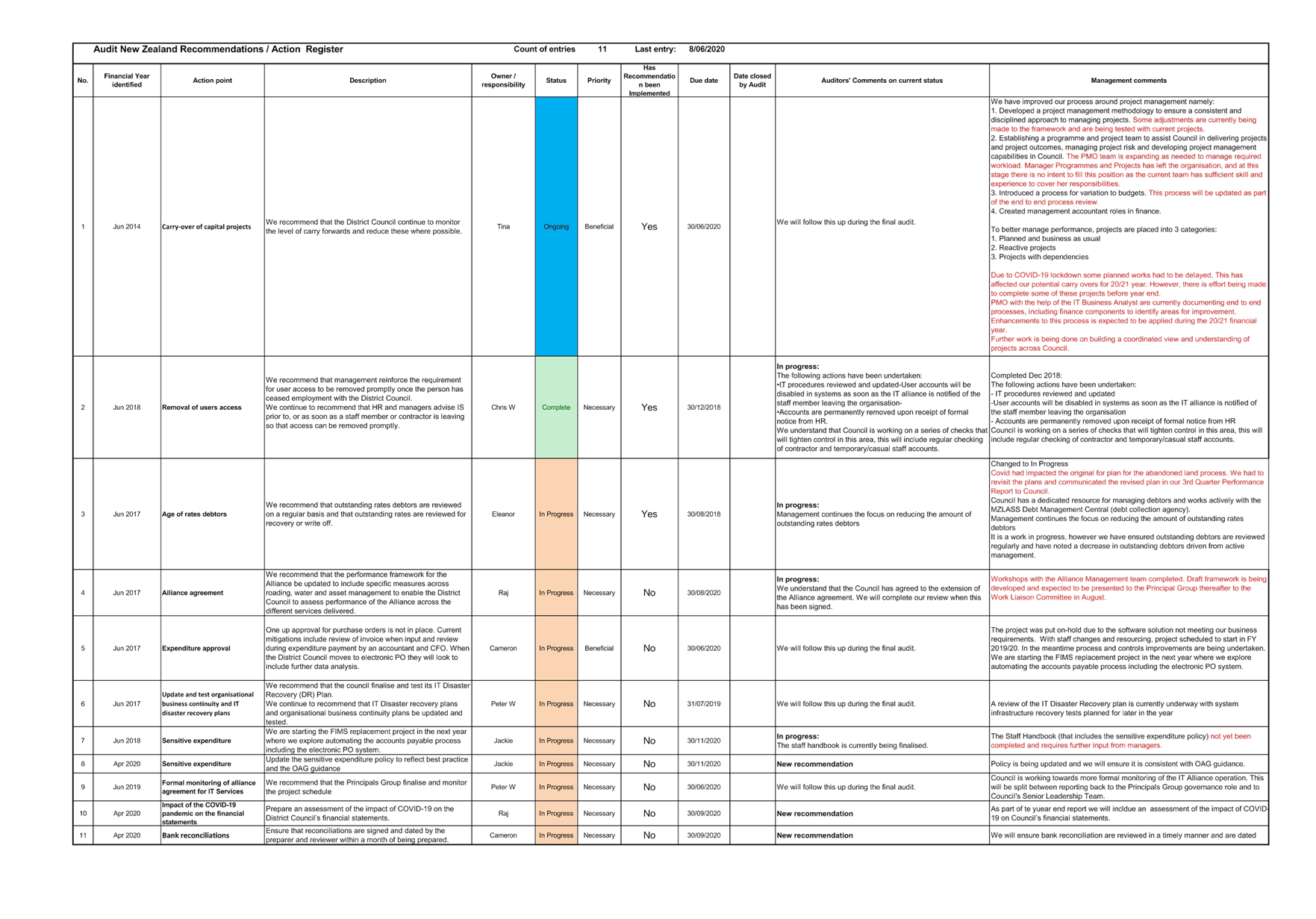

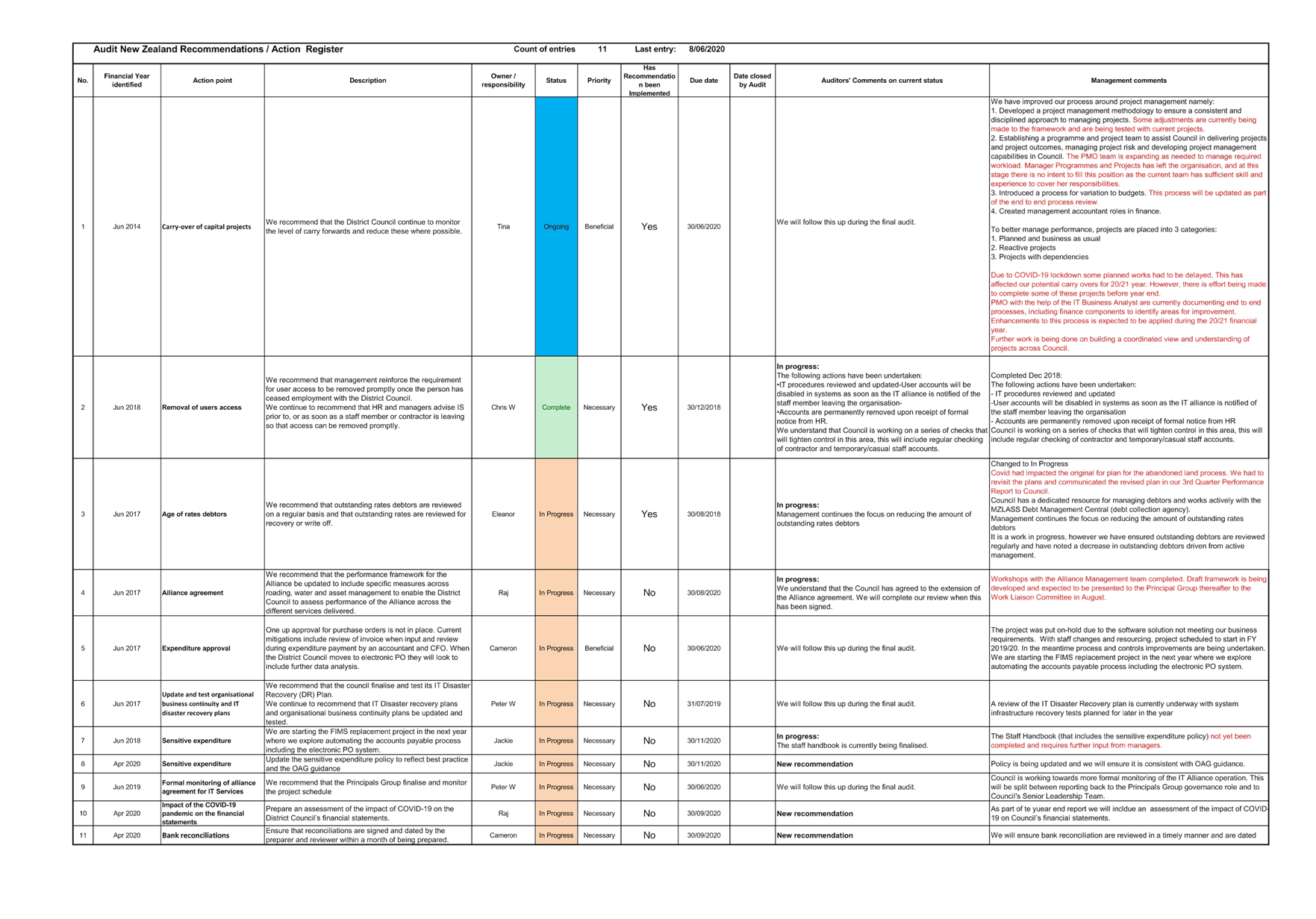

1. Reason

for the Report

1.1 To

update the Audit and Risk Committee on progress with Audit New Zealand’s

audit findings and recommendations. A summary of the findings and management

progress are detailed in the attachment - Audit New Zealand Recommendations/

Action Register.

2. Progress

Update on Existing Recommendations

2.1 The

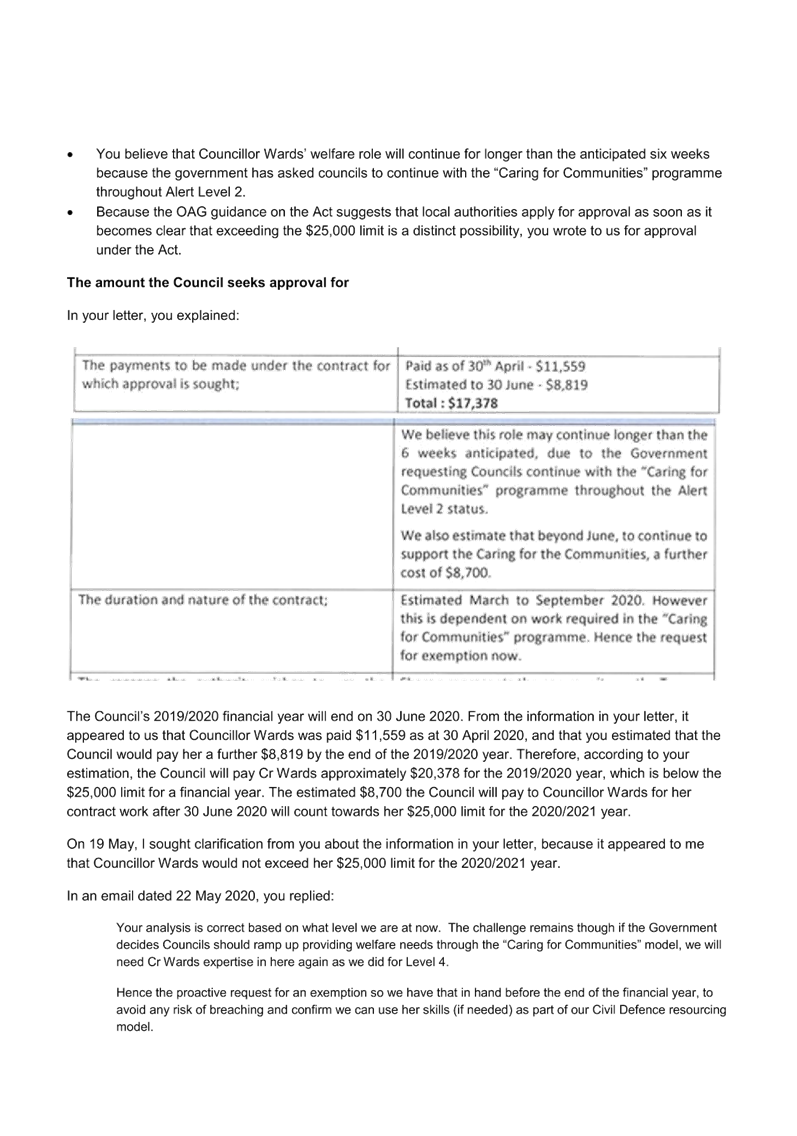

2020 Draft Audit NZ Management Report has 3 new recommendation and 8 previous

recommendations still open. The status of the 8 previous recommendations are: 1

is on-going, 1 is completed by management and the remaining 6 are in progress.

2.2 The

oldest of the recommendations is the carry-over of capital projects. This year

Covid-19 had a significant impact on project completion. In the 2020/21 Annual

Plan Council have planned to carry forward $4.62 million of the current year

budgets.

2.3 One

recommendation has been changed from complete to In-Progress. This is the age

of rates debtors. Covid-19 had impacted on the original for plan for the

abandoned land process. Staff had to revisit the plans and communicated the

revised plan in the 3rd Quarter Performance Report to Council.

3. Outstanding

Recommendations

3.1 The

attached report details the 11 recommendations, their status and

management’s comments. Changes to management comments from the update in

March 2020 are in red.

4. New

Recommendations

4.1 During

the interim, the auditors raised 3 new recommendations. They are:

· Sensitive expenditure - Update the sensitive expenditure policy to

reflect best practice and the OAG guidance

· Impact of the COVID-19 pandemic on the financial statements -

Prepare an assessment of the impact of COVID-19 on the District Council’s

financial statements.

· Bank reconciliations - Ensure that reconciliations are signed and

dated by the preparer and reviewer within a month of being prepared.

Management

will look to resolve/address these issues by November this year.

5. Conclusion

5.1 Management

continues to address the audit recommendations.

5.2 Three

new recommendation were raised by Audit NZ.

5.3 Management

will provide an update on the progress at each Audit and Risk Committee

meeting.

|

6. Recommendation

6.1 That

the report from the Chief Financial Officer dated 9 June 2020 concerning

Progress with Audit New Zealand Findings and Recommendations (as

circulated) be received, and

6.2 That

the Audit and Risk Committee note management’s progress in addressing

the eight outstanding Audit New Zealand recommendations, and it shall

continue to provide updates on this matter as progress is made, and

6.3 That

the three new Audit New Zealand recommendations made in their Interim Audit

with regard to the impact of the Covid-19 pandemic for reference in the

financial statements, review of bank reconciliations and updating of the

sensitive expenditure policy be noted.

|

Attachments

1⇩. Audit Recommendations Action and progress

updates register 8 June 20

6.4 Progress with

Audit New Zealand Findings and Recommendations

Attachment 1 Audit

Recommendations Action and progress updates register 8 June 20

|

Date

|

:

|

9 June 2020

|

|

To

|

:

|

Chairperson and

Committee Members

Audit and

Risk Committee

|

|

From

|

:

|

Raj Suppiah

Chief

Financial Officer

|

|

Subject

|

:

|

Audit New

Zealand Letters for Audit Engagement, Audit Plan and Audit Fee Proposal

|

|

Item No

|

:

|

6.5

|

1. Reason

for the Report

1.1 To

review and recommend the Audit New Zealand’s Audit Engagement, Audit

Arrangement and Audit Fee Proposal letters for approval by Council.

2. Background

2.1 The

Auditor‑General is the auditor of all “public entities” under

section 14 of the Public Audit Act 2001 (the Act).

2.2 The

Auditor‑General has appointed Audit New Zealand under sections 32 and 33

of the Act, to carry out the annual audits of the District Council’s

financial statements and performance information.

2.3 Debbie

Perera is the Appointed Audit Director.

2.4 The

letters attached to this report are:

2.5 Audit

Engagement Letter

2.5.1 This letter

outlines the terms of the audit engagement, the nature and limitations of the

annual audit, and the responsibilities for both Council and the Appointed

Auditor for the audits ending 30 June 2020 to 30 June 2022 financial years.

2.5.2 Management has

reviewed this letter and is agreeable with the content.

2.6 Audit

Plan – Audit for the Year Ended 30 June 2020

2.6.1 This letter

outlines the audit plan for the audit of Tararua District Council Annual Report

for the year ending 30 June 2020.

2.6.2 The areas of

focus are detailed in pages 2 to 5. These areas differ from year-to-year and

are determined based on what the Audit Director has assessed as the key

business risk and issues facing Council.

2.6.3 The areas of

additional focus for this year are the Impact of Covid-19 and Adoption of IPSAS

(International Public Sector Accounting Standards) based group accounting

standards.

2.6.4 The other areas of focus are consistent with prior years. The

additional emphasis this year will be the focus on the Tararua Alliance,

particularly – the Saddle Road improvements completed by New Zealand

Transport Agency.

2.6.5 Management

will discuss with the Audit Director as to what work this review entails and

work with the Audit Director and the audit team, so staff can be better

prepared for the audit.

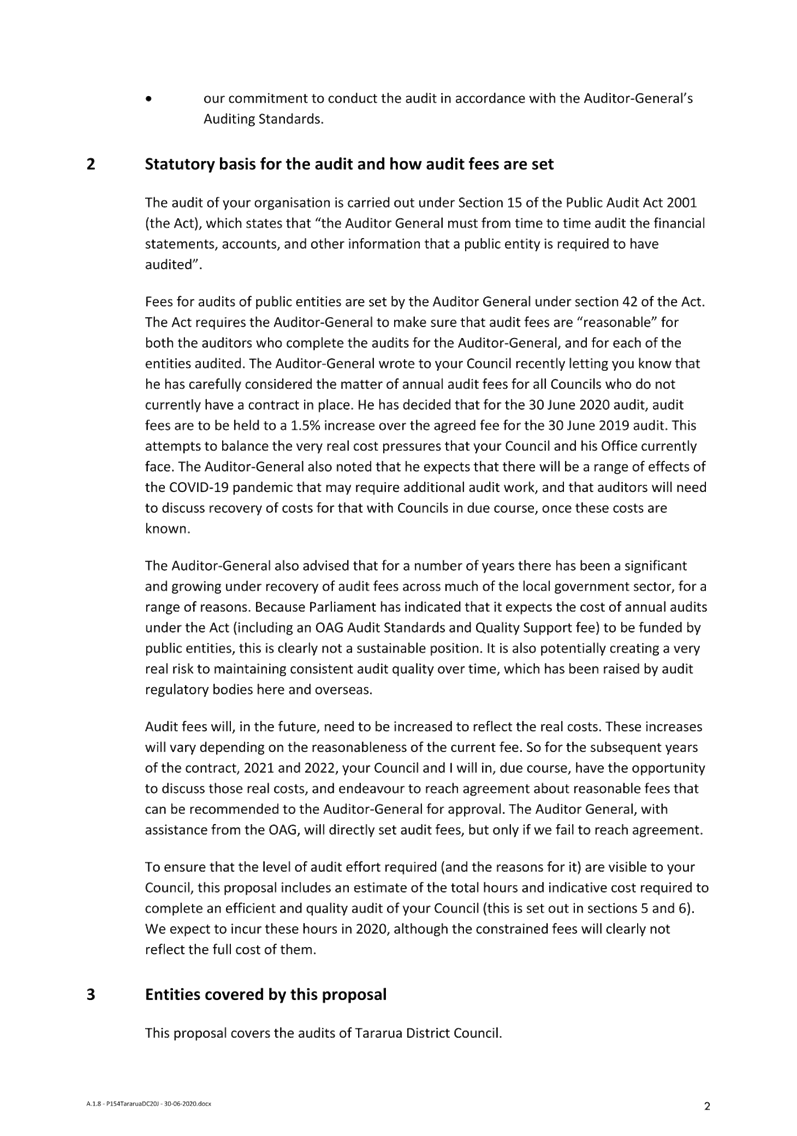

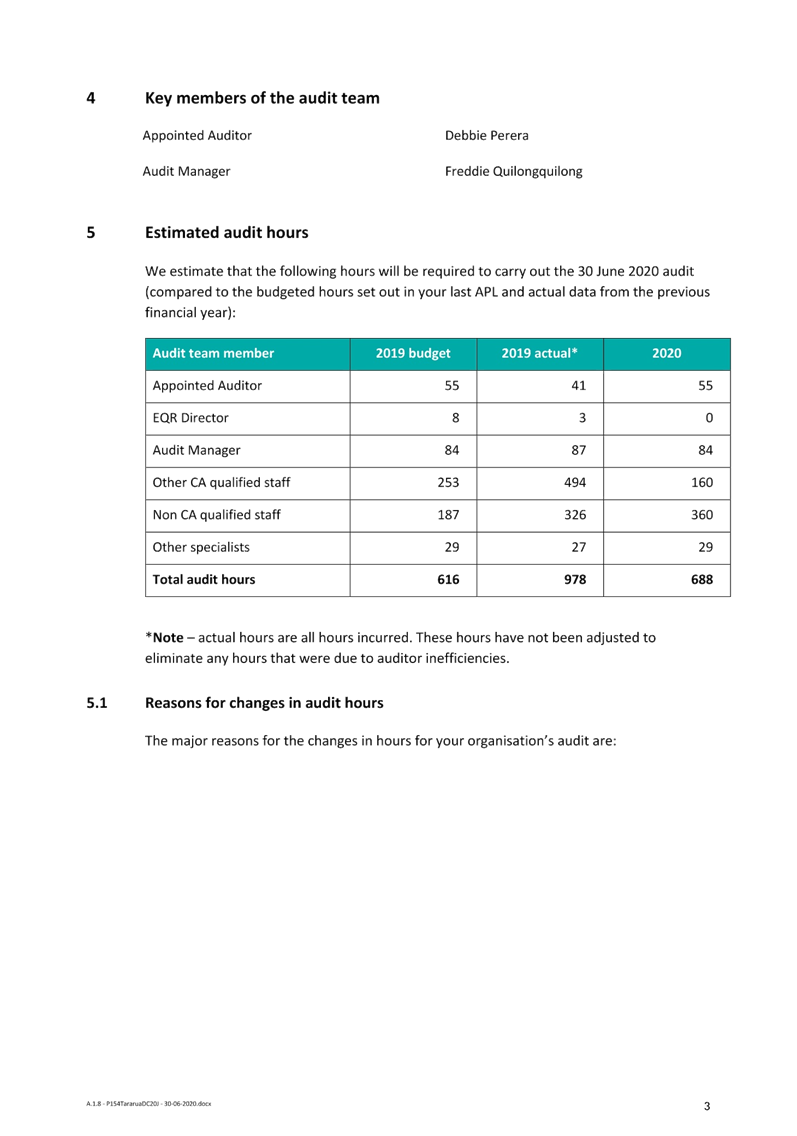

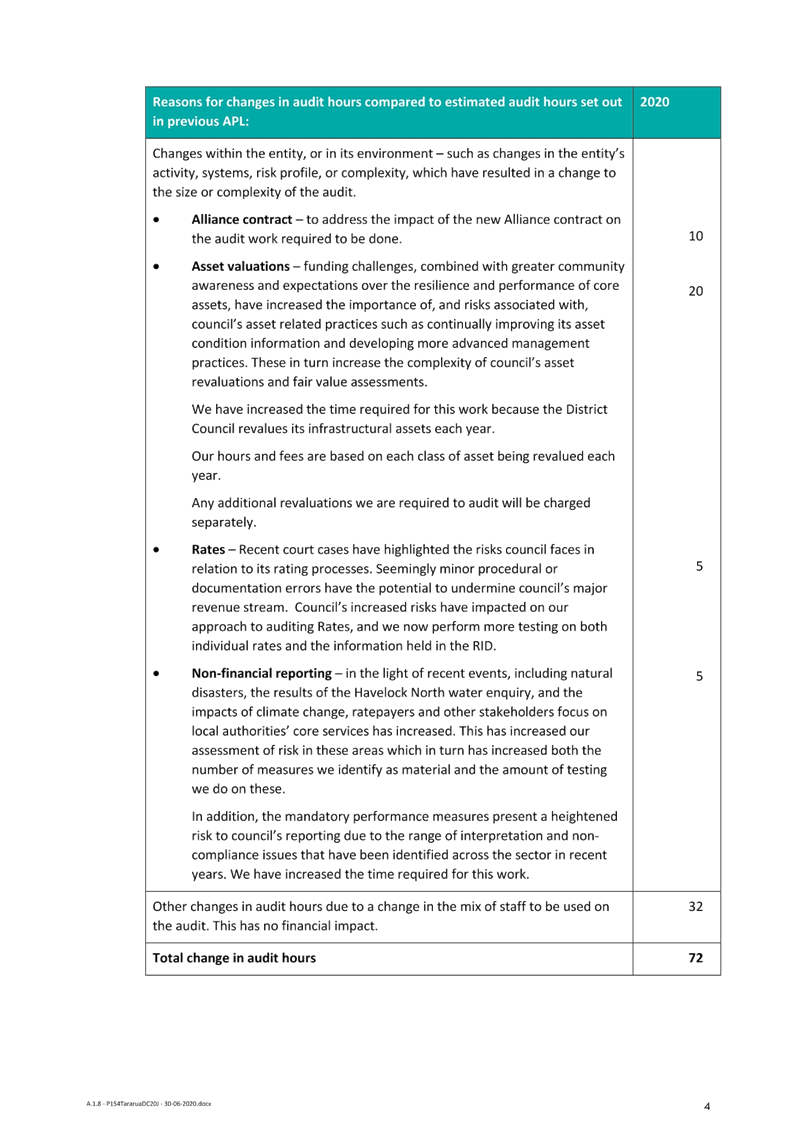

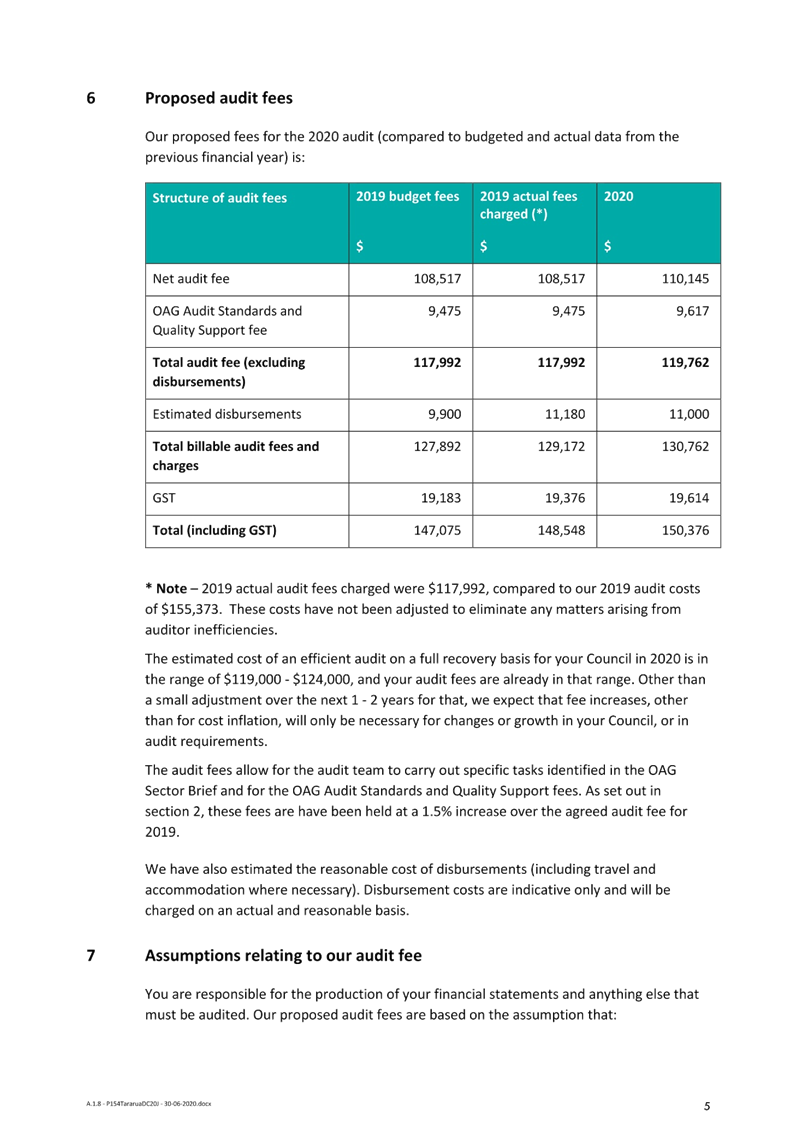

2.7 Fee

Proposal Letter – Proposal to conduct the audit of Tararua District

Council on behalf of the Auditor-General for the 2020, 2021 and 2022 financial

years

2.7.1 This letter

outlines the hours and the audit fees for the financial years ending

30 June 2020, 2021 and 2020 and reasons for any change.

2.7.2 Fees for

audits of public entities are set by the Auditor-General under section 42 of

the Act. The Act requires the Auditor-General to make sure that audit fees are

“reasonable” for both the auditors who complete the audits for the

Auditor-General, and for each of the entities audited.

2.7.3 The fees

proposed for the 2020 audit is $2,870 (inclusive of disbursement) higher than

the 2019 audit.

2.7.4 However as

indicated in paragraph 2, the Auditor-General has indicated that the Audit fees

will, in the future, need to be increased to reflect the real costs and that

the increases will vary depending on the reasonableness of the current fee.

2.7.5 Management is

aware of this and will have ongoing discussions and work with the Audit

Director to agree on reasonable fees for the 2021 and 2022 years.

|

3. Recommendation

3.1 That

the report from the Chief Financial Officer dated 9 June 2020 concerning

Audit New Zealand Letters for Audit Engagement, Audit Plan and Audit Fee

Proposal (as circulated) be received, and

3.2 That

the Audit and Risk Committee recommend to the Mayor the approval and signing

of these letters on behalf of the Council.

|

Attachments

1⇩. Audit Engagement Letter

2⇩. Auidt Proposal Letter

3⇩. Audit Plan for the 2020 Audit

6.5 Audit New

Zealand Letters for Audit Engagement, Audit Plan and Audit Fee Proposal

Attachment 1 Audit

Engagement Letter

6.5 Audit New Zealand Letters for Audit Engagement, Audit

Plan and Audit Fee Proposal

Attachment 2 Auidt

Proposal Letter

6.5 Audit New Zealand Letters for Audit Engagement, Audit

Plan and Audit Fee Proposal

Attachment 3 Audit

Plan for the 2020 Audit

|

Date

|

:

|

9 June 2020

|

|

To

|

:

|

Chairperson and

Committee Members

Audit and

Risk Committee

|

|

From

|

:

|

Cameron McKay

Finance

Manager

|

|

Subject

|

:

|

Adoption

of Council's 2020/2021 Annual Plan and Schedule of Fees and Charges

|

|

Item No

|

:

|

6.6

|

1. Reason

for the Report

1.1 To

review the report and recommend to Council the adoption of the 2020/21 Annual

Plan and the Schedule of Fees and Charges. The adoption of the Annual Plan is a

specific requirement of Section 95 of the Local Government Act 2002 (LGA).

2. Background

2.1 Council

must prepare an Annual Plan for each financial year as required by Section 95

of the Local Government Act 2002.

2.2 The

Annual Plan, is defined by Sections 95(5) and (6) of the Local Government Act

and requires that Council present an account of significant changes from the

Long Term Plan for the year in which the Annual Plan is being developed and

include all relevant financial and funding impact statements for the year in

which the Annual Plan is being prepared. The Act also states that clear reference

needs to be made to the relevant parts of the Long Term Plan.

2.3 Council

initially held a series of workshops in November 2019, January and February

2020 to determine the service levels, capital programme, fees and charges,

activity expenditure and rates requirement for the Draft 2020/21 Annual Plan.

The result of this was the Audit and Risk Committee recommending to Council in

March to adopt a draft plan requiring a rate increase of 5.97%.

2.4 Council

decided to revisit the Draft 2020/21 Annual Plan previously recommended by the

Audit and Risk Committee due to Covid-19 and the drought affecting ratepayers

in the district.

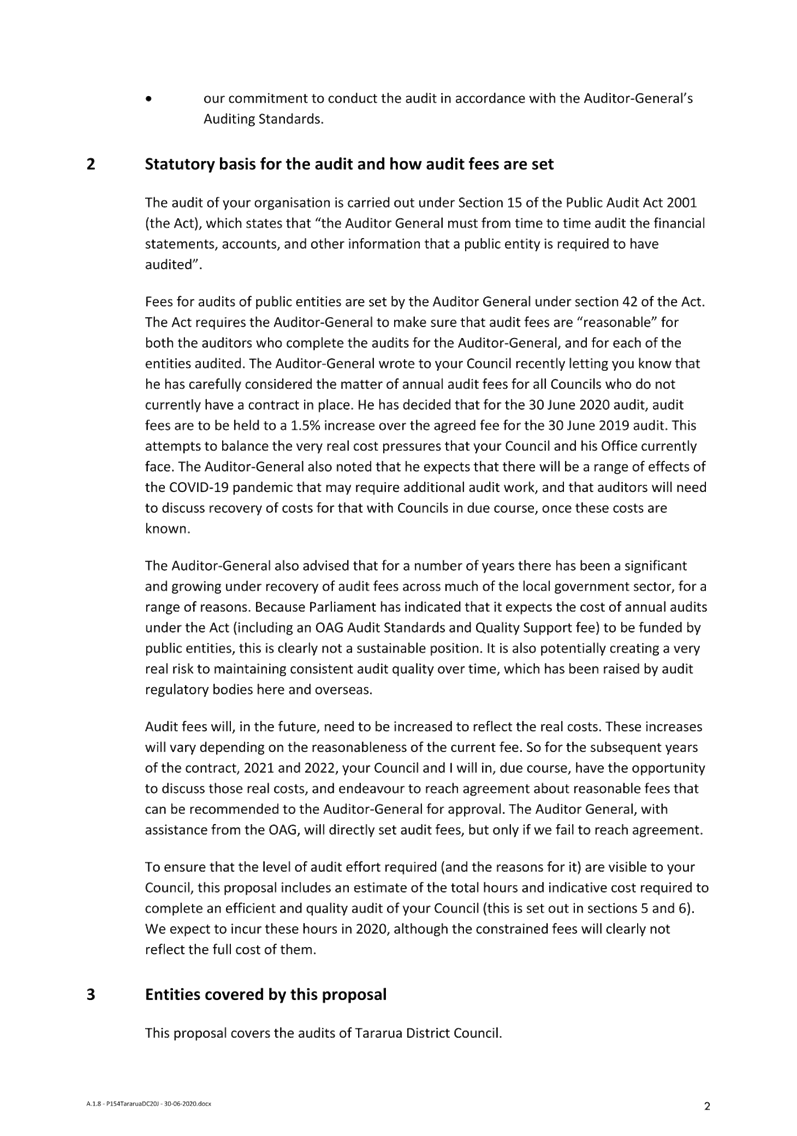

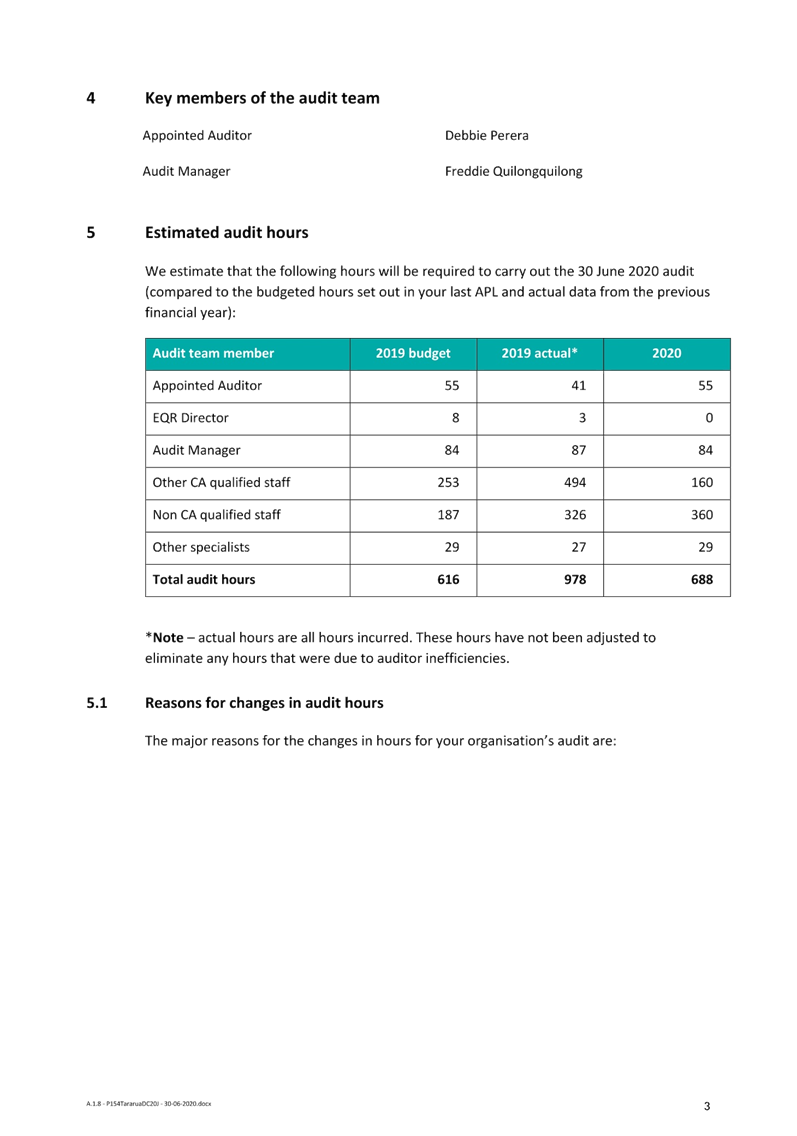

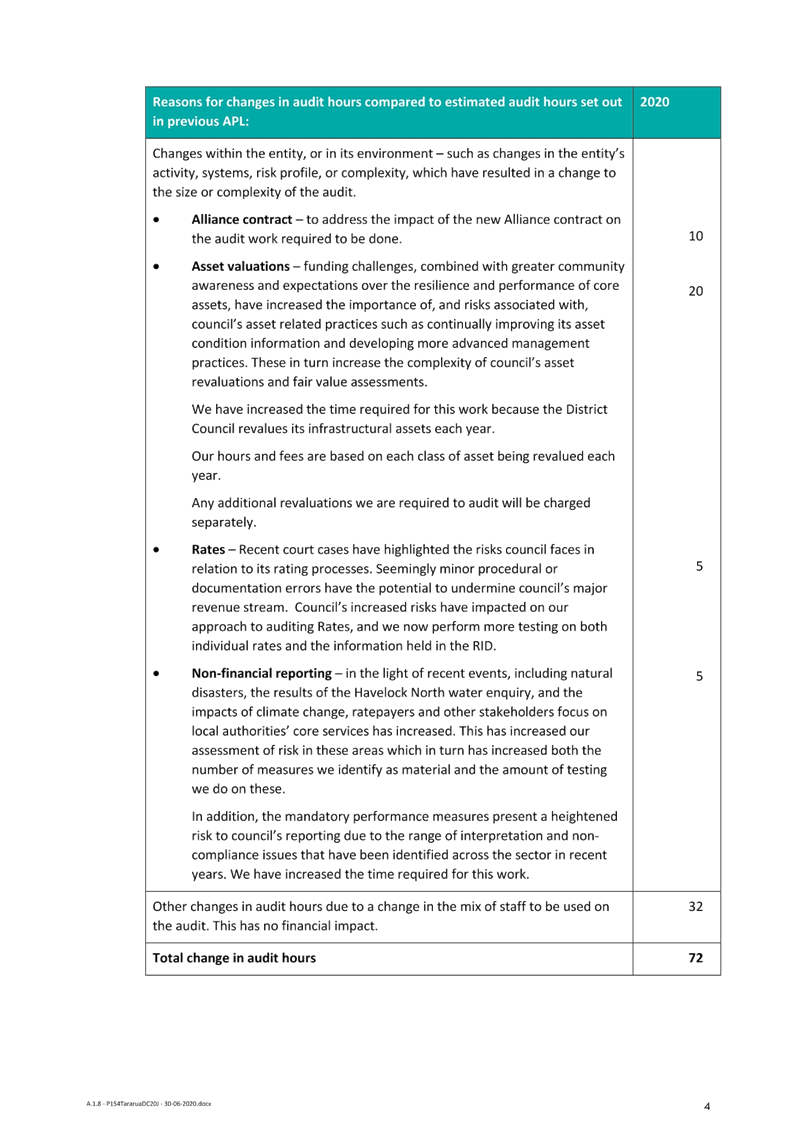

2.5 This